The Emergence of Digital Financial Services in Lao PDR

PHB Development has worked in close consort over the past four years with UNCDF* to develop a Digital Financial Services (DFS) ecosystem in what was previously a greenfield environment for digital payments.

Lao PDR is taking steps to digitize its economy, as are all other ASEAN countries. PHB Development has worked in close consort over the past four years with UNCDF* to develop a Digital Financial Services (DFS) ecosystem in what was previously a greenfield environment for digital payments. Today there are tens of thousands of new DFS users, representing nearly 1% of the adult population who are regular users of DFS. Though the numbers are relatively modest, they are significant tailwinds in this growing success story.

The Digital Finance Working Group was convened each quarter under the chairmanship of BOL as a forum for the DFS industry to address opportunities and challenges related to DFS.

When PHB first engaged in Lao PDR in September 2014, nearby Cambodia already had providers like WING with 1.5 million mobile money subscribers. Meanwhile, in Lao PDR, there were no institutions offering DFS or branchless banking – and therefore no customers. This was partly because the Bank of the Lao PDR (BoL) had no regulatory framework for this burgeoning industry.

Digital Financial Services Ecosystem

Through PHB’s work within UNCDF and with BoL – across a wide network of stakeholders for an extended period – PHB was able to help catalyze the development of the DFS ecosystem from the ground up. As of October 2018, there were multiple bank-led DFS initiatives underway, and the largest mobile operator had launched the first-ever pilot of a mobile wallet under the authority of the Bank of the Lao PDR.

The four-year journey was led locally in Lao PDR by UNCDF under the directorship of the central bank, BoL “Businesses have increased confidence to make investments in the Fintech market here, and that is a big change. The work of all of these partners has created the opportunity for services like mobile money wallets, branchless banking, digital microfinance and QR code-enabled merchant payments to begin to flourish,” said David Kleiman, a PHB Senior Consultant, and UNCDF DFS Consultant in Lao PDR from 2014-2018.

This ecosystem development grew across multiple dimensions including financial institutions, and new payment service providers, with BoL as the regulator. PHB supported early market entrants including BCEL** and Unitel to develop business plans while advising BoL on establishing suitable and enabling digital policies. This approach ultimately supported the introduction of the first-ever DFS services in Lao PDR, including:

- BCEL’s Community Money Express (BCOME): now in their second phase initiative for branchless banking which includes account opening with an instant issue ATM card and the ability to make P2G payments for road tax – as well as other standard branchless banking services. These innovations were supported through PHB Development’s team over a period of more than 18 months through all phases of preparation, testing, training, pilot and launch. See the multi-media case study “The Dawn of Digital Finance in Lao PDR.”

- Unitel, the largest Mobile Network Operator (MNO) in Laos, and part of the Viettel Group was supported by PHB to establish Star FinTech Co Ltd (SFT) to meet compliance obligations of BoL and develop the most suitable DFS service for the Lao PDR population. PHB conducted research applying the principles of Human Centered Design to support the creation of branding and the development of the U-money mobile wallet. SFT received approval to launch a commercial pilot of U-Money in September 2018.

David Kleiman (standing, right) facilitating a session at the ADB Financial Regulatory Training for Mobile Financial Services, attended by BoL and 15 other regional central banks – hosted by the Bank of Thailand.

The establishment of the BoL Payment Systems Department in early 2018 presented another opportunity for PHB to support UNCDF in developing training on the principles of DFS for the new department. This training helped department staff get up to speed on DFS topics and supervisory approaches to e-money, agents, and customer protection – resulting in better understanding and interpretation of the recently enacted National Payment Systems Law.

“The actors all needed an on-site resource person, someone who could be called upon by any stakeholder – UNCDF and its partners, the Bank of the Lao PDR and wider stakeholders such as other banks, MFIs, MNOs or Fintechs – as a neutral advisor to address specific questions associated with the rapidly changing DFS climate. As the UNCDF DFS Expert, my role was to bring together stakeholders on digital implementation and strategy issues,” said David, “The results really speak to the ambition of BoL and tenacity of the UNCDF. Although there was no clear concept of regulation for DFS when PHB arrived, now there is a national payment system law; a department within BoL to implement it; providers offering appropriate services and most importantly…customers.”

“A lot of learning took place through workshops and training that can lead to further positive development. We are seeing a growing set of use cases beyond simply remittances, and that points to further adoption of DFS in the country,” said David.

*PHB worked directly with UNCDF’s global initiative known as MM4P, and the Lao PDR national implementation program MAFIPP (Making Access to Finance Inclusive for Poor People)

**Banque Pour Le Commerce Extérieur Lao Public, the largest bank in Lao PDR

(More on PHB training)

Featured PHB-facilitated workshops during this period:

• Building Effective Agent

Networks: Training and exposure workshop for banks and non-banks to

understand how to scout, select, recruit and manage agents for DFS.

• Digital Finance and Interventions Models for MFIs:

Support to MFIs interested in the digitalization of their business and

introduction of DFS. Based partially upon the models discussed in the 6-part Toolkit Series “How to Succeed in Your Digital

Journey,” a series of practical guides for financial

service providers from PHB Academy, UNCDF MicroLead and the MasterCard

Foundation on DFS.

• Asian Development Bank Financial Regulatory Training Initiative (co-facilitated

by PHB in Bangkok): Supported three representatives from BoL to attend this ADB

training program with regulators from 16 other countries on Electronic Banking

and Mobile Financial Services.

• National Payment Systems Act as applied to Digital Financial

Services and Financial Inclusion: Training for 13 technical

staff of the newly formed Payment Systems Department (PSD), and focused on

understanding aspects of the National Payment Systems Law (NPS) as as related

to DFS and the department’s role in inspection, strategy, audit, policy and IT

policy.

• AML/CFT Principles for Digital Finance Providers: Training

workshop – followed by individual coaching with two providers – about the

compliance requirements under the AML law and risk mitigation strategies.

A previous PHB blog on DFS development in Lao PDR was published in June 2017

The mWater story through photos: Water accessibility with DFS+

How can digital finance assist the poor in attaining basic necessities? DFS+ is a term for digital financial services that enable the poor to have better access to basic utilities of life including health services, water and education.

How can digital finance assist the poor in attaining basic necessities? DFS+ is a term for digital financial services that enable the poor to have better access to basic utilities of life including health services, water and education. mWater is one such service that provides digital solutions to help find better access to clean water.

PHB would like to share some powerful photos of the daily struggles to access clean water in Benin. It is hoped that these photos demonstrate the need and amount of effort for the poor to access water.

mWater is a project of Manobi, Mobile for Development, that serves 150 water systems in Benin. The “Services to Improve Rural Water Service Performance in Benin” project links administrators, operators, managers, inventory agents and households to make water resources more accessible for the poor. PHB Development assisted GSMA and Manobi in various data and linkage aspects of this project.

Philippe Breul and Jean Pouit of PHB trained data collection agents in the field to gather data for a baseline survey to be supervised by GSMA. After meeting stakeholders including the World Bank, the PHB team met mobile network operators (MTN, Moov), CePEPE, and banks before field visits in the Sakété and Zogbodomey regions in December 2015. The goal was to better understand the mWater ecosystem: operators, final users, and mobile agents. After training data-collection agents for each region, a questionnaire was finalized to feed the baseline survey, and then validated by GSMA in 2016. Furthermore, PHB along with the other supporting organizations of the project helped establish links with mobile money agents for the payment of water usage.

Manobi converging solutions (Mobile 2 Internet) are optimizing the performance of this industry. They are exploited in rural and urban locations in several areas:

- Participatory management of the infrastructure of access to water

- Maintenance of rural networks of water access

- Curative and preventive maintenance of water supply in an urban area

- Regulation of operations and maintenance

- Mapped inventory and inspection of water networks

For more information on the project, please contact Jean Pouit at jpouit@phbdevelpment.com.

Contribution: Jean Pouit

Gender-inclusive digital for true financial inclusion

Women in some countries have been historically under-represented in digital outreach and may tend to lag men in the uptake of newly-offered digital products.

Opportunity International is enabling more women to benefit from DFS

Women in some countries have been historically under-represented in digital outreach and may tend to lag men in the uptake of newly-offered digital products. In Ghana, for example, where Opportunity International (Opportunity) has a customer base of over 65% women, it was discovered that women represented less than half of the customers registered for mobile banking. Furthermore, when it came to the actual use of mobile banking services, women represented less than 30% of active users.

Opportunity is running a number of gender-focused initiatives aimed at addressing some of the barriers women face in using digital financial services and to pave the way for women to take part in the growing digital ecosystem. An Opportunity study with around 100 participants from three regions of Ghana shed light on some of the challenges faced by women clients in their adoption of mobile banking. These participants included women customers who had voluntarily registered for mobile banking, but had never used the service or had stopped using it shortly after registration.

The main gender-related challenges uncovered through the research were:

- Lack of sole ownership of a mobile phone (many women shared a phone with members of their household)

- Low levels of literacy and exposure to technologies

- Perceived self-doubt or self-blame in dealing with new technology-related products & services

“While the issues of phone ownership and literacy were commonly known to our staff, the findings around certain perceptions as a limiting factor for women were less understood,” said Dana Lunberry, a researcher with Opportunity Knowledge Management, who led the study. A number of the women expressed concerns around asking for assistance, and others had forgotten their pin codes and never asked for help because they were concerned about how their “forgetfulness” might be perceived. Women have often been characterized in industry literature as being less confident and more risk-averse than men especially when it comes to adopting new technologies. “Irrespective of the causes, these concerns existed and needed to be addressed,” added Nick Meakin, Opportunity’s Digital Financial Services Director for Africa.

With support from PHB Development, a set of women-focused training materials were developed in this Ghana initiative with an emphasis on creating a safe space that welcomed questions to support customers to build digital literacy. “The initiative helped field staff reconfigure their roles from being receivers of questions to question-seekers, and to perform more as coaches to help customers in their digital journeys,” said Ms Lunberry.

Opportunity’s gender-focused digital initiatives are moving forward with attention to the realities faced by individuals within their communities. Further work is set for 2018 to address some of the key challenges faced by a number of Opportunity’s women clients, such as low levels of literacy and technological exposure, through voice-based messaging and community outreach.

A goal is to not only to attract and assist female clients, but also female Agents. Experience in other countries has shown that women not only perform better than men as Agents, but also that female clients often feel more comfortable visiting a female Agent. And for a sustainable benefit, organizations must better understand offering the right products and creating the right environment to promote gender inclusivity, which can be a complex transformation that benefits communities overall.

Opportunity International and PHB Development have been teaming up through PHB Academy training programs to better target the implementation of digital financial services. For more information on PHB training and partnership activities with Opportunity International, contact Pete Sparreboom: psparreboom@phbdevelopment.com.

PHB Academy Embarks on new DFS Training Initiatives in Uganda

“Complex issues were made understandable, drawn from extensive Ugandan and global experience,” said Tamsin Scurfield of Opportunity International about participating in a recent PHB Academy training in Kampala, Uganda.

“Complex issues were made understandable, drawn from extensive Ugandan and global experience,” said Tamsin Scurfield of Opportunity International about participating in a recent PHB Academy training in Kampala, Uganda. A dozen people took part in the 5-day course – 27 Nov. to 1 Dec. – from organizations including FINCA Uganda, FINCA International, Opportunity International UK, Opportunity Bank Uganda and Uganda Management Institute.

The hands-on, interactive sessions covered understanding the Digital Financial Services (DFS) ecosystem, selecting a DFS business model, agent banking, mobile banking and partnerships, and funding DFS. “The week after training, we used the material to guide into a DFS strategy. A draft strategy has now been put together and the training provided a clear roadmap for this – so participation was very relevant,” added Tamsin about the courses.

These training sessions were held at the Uganda Management Institute (UMI). Courses facilitated active sharing of expertise from both instructors and participants and were intended to be the first in a series of such sessions. “Not only did the facilitators give sufficient and relevant examples, but they also allowed us to bring own examples,” said Don Twine, from FINCA Uganda, who participated in the training. PHB is further coordinating with the UMI to establish a partnership around training and consulting to support the ambitious Uganda strategy for financial inclusion, with the next training session scheduled for March 2018.

Mr Philippe Breul and Dr Henry Clarke Kisembo, of PHB Development/PHB Academy, led this course instruction in Kampala. “We’re also working with FINCA and Opportunity International on an ambitious financial inclusion initiative for the South Sudan refugees in Uganda, as part of the in-depth work done during the training, said Philippe.

Objectives in this training course included:

• Understanding ways to use technology to further the goals of a financial institution.

• Understanding DFS concepts and distinguishing different business models.

• Understanding the costs and risks of DFS for different stakeholders.

• Being able to strategize with senior colleagues about DFS priorities.

• Being able to assess potential partners and help negotiate mutually beneficial deals.

• Being able to sell DFS projects to regulators, boards, owners and funders.

And coming soon on the PHB Development website: The PHB Academy Training Catalogue with details about our specialized learning opportunities on Digital Financial Services!

Adapt or Die! A Changing Landscape for Microfinance

“A large part of the financial sector is not adapting well to new market environments and seems to have lost focus on the mission to provide financial services to the poor,”

How are changes in technology and customer preferences driving the financial inclusion market? What is PHB Development doing to deliver in this changing landscape? PHB founder, Philippe Breul, and PHB Academy Co-Director, Pete Sparreboom, share insights on trends and solutions to connect with customer needs:

With the support of PHB Academy, Philippe taught two courses in the Summer 2017 session of Boulder Microfinance Training in Italy, which was also the first year that Boulder featured a special track on digital finance (DF). In a sign of the times, DF courses were oversubscribed, and additional instruction was added to help meet the demand.

“A large part of the financial sector is not adapting well to new market environments and seems to have lost focus on the mission to provide financial services to the poor,” said Philippe about trends he is seeing in the sector, “By conducting extensive client research, PHB helps financial institutions develop new products that deliver a good value proposition to both the institution and customers. This helps them stay faithful to their original mission.”

PHB Academy conducts research and provides online instruction on how to stay ahead of changing needs of the market, and apply innovations to deliver the right services to customers. Pete Sparreboom, PHB Academy Co-Director, said “Microfinance institutions that do not adapt to demand are putting their portfolio and bottom line at risk. It’s important to address clients’ demand for services that will save them valuable time and effort. Mobile money operators are getting ahead of traditional MFIs because clients are no longer accepting to wait several weeks for loans after complicated applications and travel distances to branch offices. Customers expect convenience and ready access to a range of services. It’s that simple.”

The Digital Finance Toolkit series (from PHB, UNCDF MicroLead and the MasterCard Foundation) allows financial institutions to connect effectively with the market and customers through the introduction of digital financial services. “PHB is striving to remain a leader in the sector through a human-centric design approach to mobile technology,” said Philippe, “We conduct extensive field research that leads to prototyping, testing and then the development of a solid strategy that covers the customers’ needs.”

For the future of microfinance institutions, Philippe said, “It’s crucial for microfinance institutions to update their operational models and strategies, and bring the changes prominently into the market. It is really an adapt-or-die situation. PHB with PHB Academy is leading the way to deliver modern benefits in line with our mission and values of financial inclusion.”

Work (and play) in an Active PHB Summer

PHB Development recognizes the importance of a healthy of balance work and home life, so while many of our associates and clients are enjoying summer holidays, we also ensure that existing client needs are met in a timely manner.

PHB Development recognizes the importance of a healthy of balance work and home life, so while many of our associates and clients are enjoying summer holidays, we also ensure that existing client needs are met in a timely manner. As this Summer 2017 season nears an end, we would like to take a brief look at the results some of our staff have been pursuing.

Isabelle Musat has been busy in the continuing development of a series of Toolkits for financial service providers, in partnership with UNCDF MicroLead and the MasterCard Foundation. The series of 6 practical Toolkits is designed to guide financial institutions in introducing digital financial services and boosting their uptake. Four of the hands-on guides have been published so far, and have been described as a “recipe for success.”

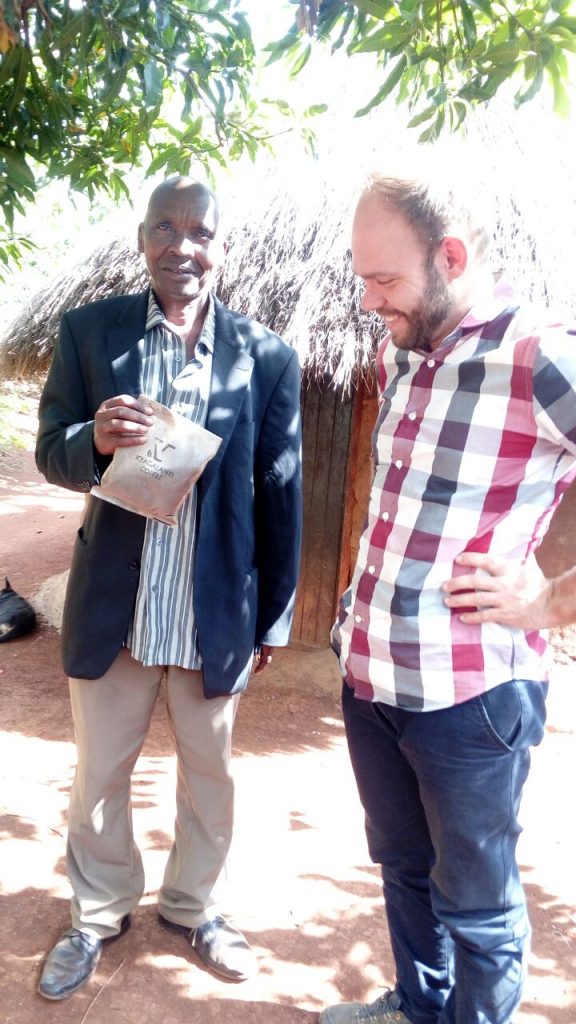

Chris Statham lives in Malawi and is supporting FINCA Malawi through research, implementation and the launch of a mobile savings-and-loans product. His efforts include assisting in applications for funds that will be used to create and introduce innovative DFS products. Chris supports FINCA Zambia in their proposal for Mobile Savings and Loans product funding, and is also part of the ‘Toolkit team’.

Andrew Tumwesigye is working on the pilot phase of DFS implementation at Mcleod Russel tea company in Uganda. He is supporting various aspects for the payment service provider MTN to scale payments to tea workers at the Muzizi tea estate:

- Designing payee registration processes

- Payment processes & procedures

- Activity work and roll out plans, including training and sensitization

- Pre & post payment assessments

Jean Daniel Baloucoune is based in Senegal and working on the diagnostic study of the capacity of La Banque Centrale des Etats de l’Afrique de l’Ouest (BCEAO). The study analyzes payments data and payments systems, aiming to identify commercial opportunities and refine BCEAO’s regional financial inclusion strategy. PHB is happy to be meeting the needs of its clients during the summer months and our staff are looking forward to new possibilities in the rest of 2017 on onward!

Interview with PHB Associate Emmanuel Mudahemuka

Emmanuel Mudahemuka is based in the Netherlands and specializes in external mid-term and post evaluations of programs for regions including North Africa.

PHB Development associates and consultants are deployed in various countries working on projects to serve clients. Emmanuel Mudahemuka is based in the Netherlands and specializes in external mid-term and post evaluations of programs for regions including North Africa. As a PHB associate, he was happy to share thoughts on his field experience for the PHB blog.

What are your current projects?

I am working on a mid-term evaluation for the Swiss Investment Fund for Emerging Markets in a North African focused initiative. My role involves reviewing evaluations and conducting field interviews to assess if the intended objectives are being met.

What challenges you are facing in the field?

The biggest challenge is non-cooperation from the beneficiaries, especially if the evaluation concerns a closed project and they don’t clearly see the benefit for them. Quite often, there are multiple views of who is the targeted beneficiary of the project between the project sponsor and other stakeholders. For example, there may be several definitions of what is a small and medium enterprise depending on the stakeholders: banks, microfinance institutions, governments, tax authorities, NGOs etc.

What interests you the most about working on the field?

While interviews are sometimes conducted over the phones, the field visits help provide a complete understanding of the background and situation of the people. The combination of interviewing people, observation and environment scanning allows me to more accurately place the project and discussion in the local context.

What has been your best on-field experience and why?

My trip to North Africa, where I found small and medium enterprises that were very professionally managed – I visited several successful enterprises that should serve as role models. The enterprises included a private engineering school, a pharmaceutical company and a logistics company. These companies provided jobs and training, while also supporting local economies.

Why do you work in financial inclusion, and what do you like best about working for PHB?

Before joining PHB Development, I worked for over seven years in financial services industry in Rwanda. It started as a simple idea: What can I do to help my village, and for other African villages to have access to opportunities and lift themselves out of poverty? PHB Development gave me a platform to channel my passion into helping people improve their access to finance.

Interview with Pall Kvaran

PHB Development values the diversity and innovation that its consultants can bring to developing financial inclusion systems nearly anywhere on the planet. PHB Associate, Pall Kvaran, recently shared views from his current work in Uganda.

PHB Development values the diversity and innovation that its consultants can bring to developing financial inclusion systems nearly anywhere on the planet. PHB Associate, Pall Kvaran, recently shared views from his current work in Uganda.

What are the areas of need you currently working on?

I am working on two different projects, one in tea and one in coffee, both focused on helping farmers gain access to digital financial services. We move towards achieving this goal by digitizing the payments farmer receive for their major cash crops. By doing this, we help them get access to services such as savings accounts and loans through mobile money.

What are the challenges you are facing and what are you doing to solve them?

The coffee project I am working on is all about problem-solving. This project is funded by CGAP and UNCDF, and we are working with one of the largest coffee companies in Uganda. UNCDF has been working on digitizing payments to farmers for a couple of years and PHB was tasked with doing a deep dive and figuring out what the most important problems are and how to solve them in order to make the digitization effort work as effectively as possible.

We used a new method we call Value Proposition Mapping, where we essentially mapped all income and expenses farmers and traders in the coffee value chain engage in on a month to month basis over the course of a year. We then calculated the costs of cash and digital payments for each transaction type and figured out which ones are ready for digitization, depending on the value propositions farmers and traders face.

What is the most interesting or surprising thing that you have encountered in the field?

The extreme level of interest farmers has in spending management. Almost every farmer I have spoken to in my work in a range of different agriculture value chains sees mobile money as helping them manage their own spending to save up for investments. This can be even more true for women because they are usually not the head of the household and thus have a hard time controlling how the money they make is spent. Mobile money can really help them keep a part of their income for themselves and save up for future investment.

Where are you seeing as the current and potential impacts?

In the short term, I see the digitization of payments in agriculture value chains having a positive impact on spending management as well as the risks farmers face. Being paid with mobile money allows people to store their money safely as well as reducing the risk they face while travelling with cash. In the medium and long term, as more affordable financial services will be offered through mobile money platforms I see these farmers gaining access to interest-bearing savings accounts, loans for investments and important risk mitigation services such as crop insurance.

The current agricultural productivity in Uganda is multiple times lower than what it can and will be in the near future. I believe these services are of vital importance when it comes to helping farmers in developing countries increase their production and income.

How do local traditions and ways of doing business affect your work?

I believe my work as a PHB consultant is actually centered around this very question. My job is gain a deep understanding of local contexts and use that understanding to figure out how we can best help people. I think our coffee value proposition mapping methodology does this exceptionally well, especially when we get a chance to combine it with more qualitative human-centred design methodologies.

Why did you choose to work in the field of financial inclusion, and what do you like best about working for PHB?

I strongly support development policies focused on helping people help themselves and I feel financial inclusion is exactly this. I believe the people we are trying to help are best qualified to decide what they need in order to help them better their lives.

I think providing access to financial services is one of the most important pieces in this puzzle. If we are able to give people access to interest-bearing savings accounts and loans for investment, they have been given a set of tools they can use to decide themselves what goals they want to work towards

When it comes to PHB Development, I really like the cooperative nature of the company. Most of the success of the company is channelled into reinvesting for growth and increasing possibilities. Rather than being typical employees, we function more like a group of independent consultants who work closely together towards our common goals.

Helping Refugees through Financial Inclusion

The needs of an estimated 22.5 million worldwide refugees fleeing conflict and instability go well beyond food and shelter.

PHB Partnerships on DFS to Help the Displaced and Emergency Workers

The needs of an estimated 22.5 million worldwide refugees fleeing conflict and instability go well beyond food and shelter. Access to financial services for refugees can enable those who are otherwise disconnected from their homes to mitigate the immediate financial shocks of displacement and take steps toward future opportunities. Continuing economic activity will help the displaced and aid workers to be more self-sufficient when they return home from temporary settlements.

Digital financial services (DFS) can offer refugee families such a way to meet current financial needs and plan for their future. DFS providers are increasingly tailoring services such as Mobile Money and e-payments to assist refugees through easier access to money and the ability to make financial transfers. Benefits include eliminating the risks of travelling long distances to conduct cash transactions and increased the potential to build an economic base. The long-term impacts can benefit families and regional economic stability.

Productive Safety Net Program in Ethiopia

PHB Development worked in Ethiopia with the Ministry of Finance and Economic Development for a project of the World Bank on initiatives to provide refugees with DFS – with the aim of improving their conditions through access to basic financial transactions. One example is the Productive Safety Net Program (PSNP) that enabled social transfers through digital services. Through the PSNP, recipients were able to access digital payments with full control in a timely and secure manner, with no deductions. These e-payments also helped build a culture of savings for the recipients, leading to greater financial inclusion and brighter future prospects. In addition, PSNP benefited the government and fund providers as it decreased the time, cost and fiduciary risk of cash transfers.

Remittances in Syria

PHB along with CGAP and GIZ (Jordan) worked together to provide DFS for Syrian refugees in Jordan, by implementing a secure method of transfer remittances. Such remittances are often vital for refugees, as they receive this needed money from friends and relatives in other areas. After having lost their own source of incomes, refugees have been able to receive and transfer money safely and at a low cost, through innovative DFS programs.

There is continued potential for DFS to contribute to the economic and social development of the displaced as well as their home social structures. Even modest economic activity helps raise their quality of life through better access to health services, material necessities, education and interaction outside of their temporary settlements.

Umberto Trivella (in the picture, third from right standing) on an Ebola follow-up project in Guinea.

Emergency Help to Ebola Workers in Sierra Leone

In the provision of digital services to Ebola workers located in Sierra Leone, PHB carried out agreements with local banks and money transfer providers including Airtel, Africell and Splash to transform a system that used cash currency into a system of mobile payments. This program made it easier for aid workers in the country to conduct financial transactions and receive payments through a cloud-based payroll system. The mobile payments also helped reduce fraud, theft and errors in payment to workers.

PHB consultant Umberto Trivella commented on this project: “We held discussions with workers at Ebola treatment centres to better understand their cash payment challenges and how digital channels could improve the situation. It was a good experience to enable these young workers at the forefront of the battle against Ebola to receive timely payments for their high-risk efforts.”

Agents-The Revolution on the Ground in Lao PDR

The mixed emotions of excitement and nervousness would be the best way to describe how new branchless banking agents feel in the Lao People’s Democratic Republic (Lao PDR).

Republished from the UNCDF MM4P website: https://www.uncdf.org/article/2507/agents-revolution-on-the-ground-lao-pdr

Vientiane, LAO PDR – The mixed emotions of excitement and nervousness would be the best way to describe how new branchless banking agents feel in the Lao People’s Democratic Republic (Lao PDR). For many prospective agents, who humbly regard themselves as rural, less-educated people, having the opportunity to work with the country’s largest bank is an unusual, unexpected opportunity.

In June 2015, one of the country’s leading banks—Banque pour le Commerce Extérieur Lao Public (BCEL)—launched a new concept in banking for the country: branchless banking through agents, a service the bank branded as BCEL Community Money Express (BCOME). The project was supported by United Nations Capital Development Fund (UNCDF), its national implementation programme Making Access to Finance More Inclusive for Poor People (MAFIPP) and PHB Development, from concept through pilot and on to commercial launch. Today, BCOME has more than doubled the size of the BCEL branch and service unit network, and with more than 125 agents, it is represented in every province of the country.

One of the most outstanding agents in the country, Nouteng Sybounheueang of Souvannaphoun Village in Paklai District, briefly shared her story:

First, I was worried [that] I did not make the decision right away when the staff of BCEL approached me about being an agent. I just replied to them that I needed time to think about it. And in my thoughts, I started to wonder how can one walk into my shop and offer me such a big job? Being a bank’s agent, how much money would I have to have? What kind of tasks would I be dealing with? I am only a low-educated rural woman, running a small shop selling miscellaneous goods, and I had never touched a computer or iPad.

After taking a night to think it over, Mrs. Sybounheueang called bank staff the next day to confirm her interest. She then spent two weeks preparing the agent documents, to apply and to be approved. After that, she transformed a storage room for her goods into her new office. She purchased a laptop and a printer as required by the bank, though as she completed primary school only, she did not know how to use them. However, the BCOME team arranged a one-day training at her place on how to use the computer, how to access the BCOME system and how to conduct transactions for her customers.

Mrs. Sybounheueang was among the first few BCOME agents registered in July 2015 when the project was still in its pilot phase. Since that time, BCEL has expanded the BCOME agent network across the country, with over 128 agents in every province and a target of 410 agents by the end of 2019. Yet, the quantity of agents is less important to BCOME than the consistent, high-quality service that agents must deliver. As the agents are the face of the service and there is a reputation risk to the bank for non-compliance, the quality of the service should be its first priority.

BCEL supports its agents in several ways, such as the service system, technical and operational training, marketing and publicity material, and encouragement of the agents to do conscientious self-promotion, carefully focusing on three components of performance: trust, high visibility, and location.

A successful agent like Mrs. Sybounheueang attributes her success to these three attributes but primarily to the trust she has from her customers and the bank. She knows how to use the promotional material (brochures and posters) that the bank provides, and she speaks to her community about the value of the BCOME service and the convenience it can offer them. Situated on the main road, her location is premium and highly visible. Her converted storage room serves as a dedicated BCOME service office, providing her customers a comfortable environment to conduct their transactions. She is now involved in supporting the construction of a new market for the region that is only 100 metres away from her agent location. When completed, the market will attract more customers to transact at her location.

Agents in different parts of the country serve communities with different standards of living and different circumstances. Khaek Phanthalath, an agent in Ban Tha Kok Hai, Pak Ngum District (a village about 50 kilometres from a city), explained that the transaction type that she deals with the most is receipt of remittances. People from other provinces send money to their parents or relatives who live in the village or nearby, and they come to get the money at her shop. In contrast, Mrs. Sybounheueang, the agent from Paklai District, mostly serves customers who send money to their children who are studying in the capital or other large towns. Another agent, who represents BCOME in the busy and crowded capital of Vientiane, handles more business-related transactions.

These various use cases and requirements from different communities are carefully considered by the BCOME development team, as Nanthalath Keopaseuth, Deputy Director at BCEL, explained, “Sometimes our development team even thinks that we should modify the specific product to meet the particular need of each province and locality. This is a subject that we are thinking about for the possible development of our service—we keep thinking how we can create the best product to fit the rural community.”

It is noticeable that most BCOME agents are women—women who have a business to manage, who hold a lot of responsibility in their family and who are eager to support their community. All are happy to bring the service to their village and provide more convenience for their relatives and fellow villagers, to save them the time and money of traveling a long way to a city to complete their transactions. For farmers in their village, the agent’s extended service hours, from early morning until late in the evening, help them so that they are able to focus on production and not lose valuable time conducting transactions; they can stop by and do the transaction whenever is convenient. Suddenly banking is easier and less stressful.

The commission is not the only benefit of being a BCOME agent. Agents also build friendships and share convivial moments during their workday. They also benefit from the prestige conferred on them by the brand of the first commercial bank in the country, giving them considerable standing in their local community. And, the new, efficient service of BCOME draws in more customers to agents’ existing business location; it helps their existing business grow.

BCEL has brought the new age of banking—branchless banking—to Lao PDR with a service that relies on local people becoming engaged as agents to serve their own community at their community members’ doorstep. BCOME is designed to help a new group of customers, who have until now been unfamiliar or even unaware of financial and banking services, experience these services and benefit from them. In fact, BCEL has discovered just how much money flows from people in remote, rural areas to the capital city of Vientiane and other main cities, for their children’s education, for their families and for their commercial needs.

With their enthusiastic approach to providing accessibility and to helping support growth of their communities, agents are raising the awareness of villagers (e.g., through careful self-promotion at their agent location) and educating them about the low risk, inexpensive cost and speed of the new system. BCEL supports agents with periodic awareness-raising campaigns to promote overall services of the bank, while focusing attention on the agents as the primary source of the service in the community.

As Mrs. Sybounheueang summarized, “I can give them friendly advice to use this new service—it is convenient and safe. Before they sent money to their children by a bus driver. Their children would come to pick up the money at the bus station, but they had difficulties with timing and missing the bus. It was high risk. Now more and more come to use my service. They like it here because some of them feel uncomfortable to go to the bank branch.”

June 2017. Copyright © UN Capital Development Fund. All rights reserved.

The views expressed in this publication are those of the author(s) and do not necessarily represent those of the United Nations, including UNCDF, or their Member States.

For more information, please contact

KM Consultant, Lao PDR

The Roaming Agents of Lao PDR

This pilot initiative is supported by the UNCDF Making Access to Finance More Inclusive for Poor People (MAFIPP) programme jointly operated with the Bank of Lao PDR, with support from the Australian Government and technical assistance from UNCDF MM4P.

Republished from the UNCDF MM4P website: https://www.uncdf.org/article/2940/the-roaming-agents-of-lao-pdr

On October 16th 2017, Yong Duangphachanh did not make the 2-hour journey to a banking agent point in the district town to deposit money for her children’s educational fees. Instead, she attended a Xainiyom Micro Finance (XMI) center meeting in her village in northern Lao PDR and was the first in her area to experience the latest evolution in branchless banking.

XMI has partnered with BCEL’s Community Money Express (BCOME) and since February 2017, has been providing BCOME transactions to its customers via their 7 branch offices; including Beng where Yong Duangphachanh has her XMI account. But what delighted her was that now she did not have to travel to the agent - now the agent could travel to her.

This pilot initiative is supported by the UNCDF Making Access to Finance More Inclusive for Poor People (MAFIPP) programme jointly operated with the Bank of Lao PDR, with support from the Australian Government and technical assistance from UNCDF MM4P. The programme aims to integrate microfinance institutions (MFIs) into the digital finance ecosystem in appropriate ways. As a follow up to MAFIPPs “Training on Digital Finance and Interventions Models for MFIs” in and building upon the UNCDF MFI strategy toolkits to enter the digital financial service (DFS) arena, XMI was ready to take the next step.

To provide convenience and continuous service to its remote customers XMI conducts weekly center meetings in all villages accessible by motorbike. Meetings only occur in the mornings and take about one hour typically for clients to make loan repayments, to deposit or withdraw on their savings accounts. Now, as part of the center meetings, the XMI field staff travels to the community with a laptop, printer and, most importantly, a 3G Pocket Wi-fi router to allow the loan officers to connect to the BCOME platform. There are already plans to replace the equipment with a more portable tablet and a pocket-sized Bluetooth printer. Although now customers can avail opportunities like BCOME transactions including depositing and remitting funds. Currently, XMI conducts center meetings in 3 provinces (Oudomxay, Luang Namtha, Bokeo) and 14 districts covering 415 villages.

And with all that travelling, XMI staff are well known in the communities that they serve, and they look for innovative ways to bring valuable services and raise awareness about them. As part of their mission, they conduct promotional activities at schools. Such as the outreach to high school seniors conducted by XMI at Meuang Beng High School where students were introduced to the benefits of savings and educational loans. Although XMI accounts cannot be opened by minors, it is presumed that parents will be able to avail of these services on their behalf. Additionally, XMI explained how BCOME transfers can help students who study away from home and need to receive financial support from their relatives.

XMI continues to make further inroads for financial inclusion and values its relationship with BCOME as it is a positive way to associate with BCEL (the largest bank in Lao PDR with 41% market share in retail savings and 4% in lending). The association makes people more confident in conducting banking and financial services with XMI.

This pilot activity of offering remote transactions has been well received by customers but it is not without its challenges. BCEL is cautious about allowing agents to conduct transactions away from the designated and approved premises. BCEL understands the importance of trust in agent banking transactions. And they ensure it by having an authorized signboard and customer pricing clearly displayed. XMI and their well-trained staff could offer significant assurance to BCEL. XMI has been authorized by BCEL to conduct only on-line BCOME transactions so that the BCOME remittance occurs in real-time. The customer either gives cash or the amount is debited from her/his savings passbook – the transaction will be recorded in the XMI monitoring information system only when the credit officer returns to the Service Unit. The XMI savings passbook (containing the client’s picture) can be used for formal client identification in lieu of the common ID card of the family book – a procedure mandated by BCEL to fulfill the anti-money laundering obligations applicable to commercial banks.

XMI is hampered by the lack of suitable mobile data connectivity in many communities, which would require offering off-line transactions. For example, when a customer wants to deposit or remit funds, that transaction would be executed once the officer returns to the branch office where there is a stable internet connection. BCEL is considering authorizing off-line transactions based on the success of this initial pilot with a roaming BCOME agent.

“A service such as this makes banking more accessible and can also increase business for us,” said Khanthaly Saenvilayvong, Managing Director of XMI. He accompanied the team on this first experiment and is pleased and proud that XMI is the first to bring a real-time DFS solution to a remote community in northern Lao PDR. “These DFS services will continue to develop and provide opportunities to offer more and more services - once people become aware of the service they will try it and then become regular users due to the security and convenience.”

XMI key figures (as of Q3 2017 unless stated otherwise, source: mixmarket.org)

| Nb clients | 34,280 (60% women) |

| Nb borrowers | 9,223 (72% women). Largest Lao MFI by number of borrowers |

| Loan Outstanding | 45.1 billion Kip ~$5.4mn. Agriculture loans 65-70% of the portfolio |

| Portfolio at Risk 30days (PAR30) | 2.29% |

| Total assets | 57.0 billion Kip ~$6.9mn |

| Return on Assets (RoA) | 11.9% (2016 annual) |

| Nb Service Units | 7 all acting as BCOME Service Points |

| Nb & value BCOME transactions | 117 with total value 259,457,000LAK ~USD 31,600 (October 2017, at roaming agent and XMI Service Units combined) |

DFS Expert, Lao PDR

For more information, visit

Creating a new world of banking in Lao PDR A vision for branchless banking realized

On 12 May 2015, the first branchless banking transaction was completed in a rural village in the Lao People's Democratic Republic (Lao PDR).

Republished from the UNCDF MM4P website: https://www.uncdf.org/article/2528/creating-new-world-banking-lao-pdr

On 12 May 2015, the first branchless banking transaction was completed in a rural village in the Lao People's Democratic Republic (Lao PDR). This ground-breaking transaction took place with a service launched by Banque pour le Commerce Exterieur Lao Public (BCEL), one of the country’s leading banks. The service, BCEL Community Money Express (BCOME), was the first of its kind in this largely agrarian and rural nation.

Digital financial services (DFS) in Lao PDR can have significant impact by providing access to services that the dispersed population is sorely missing. The first branchless transaction opened a new world of banking that is fast, safe, inexpensive, convenient and reliable, though the story behind the project was neither swift nor simple. The journey to launch digital finance and branchless banking took investment and planning that began years ago, in 2012, with the engagement of the Bank of the Lao PDR (BoL) and the United Nations Capital Development Fund (UNCDF).

Bringing digital finance to Lao PDR required a serious commitment by BoL, which had not yet established a regulatory framework for DFS at the time. But BoL had a vision for digital finance, that it would be an important service to broaden financial inclusion and to accelerate local development. The 2014 FinScope survey of the country revealed that access to banking services was twice as high in urban areas than in rural, with the areas without year-round road access severely affected. The two main reasons for the finding were the following:

- Distance: It takes more than one hour of travel time for at least 40% of rural people to travel from the often remote mountainous areas where they live to a bank branch or an ATM.

- Income: Most rural dwellers have unpredictable income.

In sum, banking was an awkward, time-consuming and expensive proposition for many people (see the figures for greater understanding of the financial context at the time).

In 2013, BoL hosted a two-day stakeholder conference with the support of UNCDF and International Finance Corporation to explore the benefits of digital finance for financial inclusion and to develop a strategy to implement DFS for the benefit of rural Lao people. BoL also requested a scoping mission to assess the potential for DFS in the country be conducted by the UNCDF programme Mobile Money for the Poor (MM4P), through the national implementation programme called Making Access to Finance More Inclusive for Poor People (MAFIPP). The project received generous financial support from the Australian Government.

In parallel, with the support of UNCDF, BoL went to work on creating an enabling regulatory framework for DFS to permit banks and non-banks to offer services. As Akhom Praseuth, Director General of the Financial Institution Supervision Department at BoL, explained, “The Bank of the Lao PDR has a vision for digital finance and we work on its promotion. We are focused on building a strategy for expanding access to financial services, and set the laws and regulations for mobile banking as a tool to control digital finance.” UNCDF supported BoL in its regulatory efforts by assisting BoL staff to attend different workshops and go on exposure visits to Cambodia as well as providing international regulatory experts to advise on the development of appropriate regulations. In 2014, two members of the BoL regulatory committee also travelled to the United Republic of Tanzania to meet with staff of the country’s central bank, Bank of Tanzania, to understand its role and the framework that had helped that country develop its own successful DFS ecosystem.

In the intervening period, BCEL became attracted to DFS and started developing its own vision to promote a suitable service for the Lao context. BCEL worked concurrently with a UNCDF-supported consultancy to develop a five-year business case that established a target of serving 150,000 customers annually through a network of 410 agents. “The inspiration to create this project began when we received the statistics on Lao people’s access to financial resources and the banking system in the country,” said Nanthalath Keopaseuth, Deputy Director at BCEL (the service provider for BCOME). “We like to bring the technology into the system to reduce costs and at the same time to offer the communities accessibility to funding resources. That is how it made BCEL to be interested, to carry out studies and have a hands-on approach to the project,” stressed of Mr. Keopaseuth.

BCEL is one of the oldest and largest banks in Lao PDR in terms of retail customers, branches and ATMs. In the last few years, BCEL has successfully rolled out i-Banking—a corporate Internet-banking platform—within its organization as well as a popular, highly functional mobile banking application for individual clients called BCEL One. Introducing branchless banking was a wholly new concept for BCEL and for the country that required the bank to think outside the box and to be ready to manage a range of complex challenges like merging traditional retail banking with branchless banking and digital finance. Addressing these challenges meant considering not only the technology required but the manpower and knowledge needed—as well as the capital required. Most significantly, BCEL had to change its views of the customer.

Typically, a bank builds branches and customers go to the branches. In the new world of branchless banking, the bank is in the position of going to the customer, bringing them much needed services. The concept of banking at the customer’s doorstep is highly appealing to customers, but at the same time, it can represent some level of risk for the bank.

The BCOME service relies on agents, so BCEL needed to build a relationship of trust with them and in turn inculcate trust in the agent within the community and by individual customers. To create a meaningful value proposition for BCOME agents, BCEL invested significantly in training its agents, conducting substantial marketing campaigns with agents, and teaching agents how to proactively promote the service and serve customers.

To create a clearer picture of the service, UNCDF and MAFIPP brought the BCOME development team to visit countries that have similar market situations. The team exchanged lessons learned and brought back know-how to develop a system that was well-suited to the bank, its customers and the Lao context.

After operating for over a year, the BCEL branchless banking service has seen positive signs of development. By the end of 2016, there were 128 agents working in all provinces nationwide.

“What surprised me is the result of the products that BCEL has developed, and it has been introduced to communities. The service has been well accepted in society and the product has been widely used by customers, and the number of the agents has increased,” reported Sengchanh Manivanh, BCOME Coordinator.

The success of the BCOME project is a result of the hard work of the BCEL team—and that team clearly includes the agents. As trusted leaders in their communities, they have become the face of banking for many people and are educating them about financial services. People are understanding the services and realizing that banking is not something incompatible with them. With the creativeness of BCEL to build its business model around the circumstances of the country and with the help of external organizations, BCOME is now a reality.

This is the third blog post of a series about the dawn of digital financial services in Lao PDR. Read also "Community development through digital finance in Lao PDR" and "Agents—The revolution on the ground in Lao PDR" .

June 2017. Copyright © UN Capital Development Fund. All rights reserved.

The views expressed in this publication are those of the author(s) and do not necessarily represent those of the United Nations, including UNCDF, or their Member States.

For more information, please contact:

Aliska Bajracharya

KM Consultant, Lao PDR

http://mm4p.uncdf.org/mm4p%40uncdf.org

David Kleiman

DFS Expert

10th Digital Finance Working Group in Lao PDR is a clarion call for Digital Finance

On 12 May 2015, the first branchless banking transaction was completed in a rural village in the Lao People's Democratic Republic (Lao PDR).

Republished from the UNCDF MM4P website: https://www.uncdf.org/article/3302/10th-digital-finance-working-group-in-lao-pdr-is-a-clarion-call-for-digital-finance

On 13 December 2017, the 10th Digital Finance Working Group (DFWG) was convened by UNCDF1 and the Bank of the Lao PDR2 (BoL) with the generous support from the Australian Government. Under the chairmanship of BoL, this event marked a milestone for digital financial services (DFS) in Lao PDR. Not only it is the 10th meeting a milestone, showing the commitment of BoL and the engagement of the industry, but it also highlighted a new era of digital payments in Lao PDR.

More than 60 representatives from banks, mobile network operators (MNOs), microfinance institutions and government stakeholders were acquainted with the recently ratified National Payment System (NPS) Law.

The NPS law has secured passage in the National Assembly on November 7th and is expected to be signed into law in Q1 2018. The emergence of this new policy instrument will:

- Give clarity to the industry about the roles they could play within the digital finance ecosystem.

- Mandate the creation of a payments department within BoL to issue licensing to both payment service providers and payment system operators.

- Pave the way to bring innovative, accessible and affordable payment solutions to Lao PDR.

“With emerging demand for quick access to financial services and success stories of existing products in South East Asia, Lao’s digital finance sector has also been witnessing progressive changes. For digital payments or mobile money to work in any market- collaboration is the key! There needs to be a strong dialogue and a sturdy partnership between MNOs, banks and third parties to work towards developing digital solutions that can reach the broadest portion of the population. “- Nopphorn Danchainam, Managing Director of Digio, a pioneering payment systems provider in Thailand.

Towards the end of the programme, BCEL spoke of new updates to their BCELOne mobile banking application, which has a current client base of 70,000 registered users. In November 2017, BCEL introduced the third release of its BCELOne application with an added feature of QR Payments known as OnePay. It allows account holders to make instant mobile payments to vendors simply by scanning the merchants QR code. This domestic payment service is first of its kind in Lao PDR, with a standards-based solution that will integrate into the NPS infrastructure and allow interoperability with other providers over time. BCELOne previously integrated into the UNCDF-supported BCEL Community Money Express (BCOME) service, which allows banked customers to send payments to anyone in the country using the application. Funds can then be collected from the banks’ branches or more than 200 agents nationwide. You can read the detailed case study of BCOME here and watch the video about BCOME’s pioneering role in DFS in Lao PDR.

The DFWG has served as an excellent industry forum for discussion, knowledge sharing and promotion of a new suite of services in the Lao financial services market. Looking ahead to the 11th DFWG, BoL with the support of UNCDF aspires to promote the creation of action-oriented sub committees or taskforces that can address the challenges of delivering more innovative services in Lao PDR.

1.Through the in-country joint programme with BoL Making Access to Finance More Inclusive for Poor People (MAFIPP) and the global thematic initiative MM4P↩

2.Lao People’s Democratic Republic↩

For more information, please contact:

KM Consultant

DFS Expert, Lao PDR

Or visit mm4p.uncdf.org

Community development through digital finance in Lao PDR

Sending children away from home for higher education is considered a requirement for parents to build their children’s future.

Republished from the UNCDF MM4P website: This article was first published on 21 June 2017 at https://www.uncdf.org/article/2512/community-development-through-digital-finance-lao

Using branchless banking to support education, agribusiness and more

There is an old Lao saying, ‘If you don’t go out of the village, you will not see the land far away; if you don’t go study, you will not have any knowledge.’ It is still commonly used in the Lao People's Democratic Republic (Lao PDR)—a country with a surge in demand for education, with 78% of youth enrolled in lower secondary education[1] while 56% of adults have primary education or less[2] (see the figure for more detail). Sending children away from home for higher education is considered a requirement for parents to build their children’s future. So, there is little surprise that sending money to support children’s education has become a primary use case for the first branchless banking service in Lao PDR.

Banque pour le Commerce Extérieur Lao Public (BCEL), one of the country’s leading banks, developed the branchless banking service, which is called BCEL Community Money Express (BCOME). It is entirely new; no other bank offers this kind of service in Lao PDR. Supported by United Nations Capital Development Fund (UNCDF) and its national implementation programme Making Access to Finance More Inclusive for Poor People (MAFIPP) and PHB Development, BCEL launched BCOME

in June 2015 with a small pilot of only 11 agents. Today, with more than 125 agents in every province of the country, BCOME has more than doubled the size of the BCEL branch and service unit network. Villagers perceive BCOME as convenient, quick, safe and friendly, the latter because it is offered by someone they know in their community—a neighbour, relative or acquaintance in town whom they can trust and with whom they can comfortably share their needs.

Figure from

FinMark Trust and UNCDF-Making Access Possible, FinScope Survey Highlights: Laos 2014, p.9 (n.p., November

2015).

© UNCDF MM4P

Agriculture is the backbone of the Lao economy, but farmers are dispersed, living in remote, rural areas throughout the country. Travelling to a district town can be an undue burden for them, and accessing formal financial and banking services is even more difficult both because of the distance to a bank branch and because of insufficient income and low financial literacy. These challenges have understandably led farmers to depend on cash. For them, sending money to family members in other provinces by a bus driver is a method often used, but it is time consuming and sometimes risky.

Sompong Veosy, a farmer from Souvannaphoum Village in Paklai District, grows rice and raises buffalo and cows for his income. He normally spends all day looking after the rice paddy and livestock, only leaving his farm after sunset. Taking time from his work to travel to town to complete a transaction is exhausting. But, since a BCOME agency in his village opened, his outlook has changed. “In the past, I had to travel a long way to send money to my children for their education, but now it is easy, fast and convenient. I am very, very happy now. It is perfect,“ he explained with a happy smile.

Sompong Veosy, a farmer from Souvannaphoum Village in Paklai District.

© UNCDF MM4P

The BCOME service has drawn this new customer segment to BCEL, which has been surprised to learn just how much money from rural farming communities flows throughout the country. Through the service, BCEL can stay close to these new customers and learn about their requirements.

Thong Khoun, a villager from Thakokhai in Pakngum District, regularly sends money through BCOME to her son who is studying in the southern part of the country. Sometimes, though, it is the opposite: she has an urgent expense of her own, and her son sends money back to her. “My son asked me to open a bank account so that he can send money to me in the future. So, I wish that BCOME can open the account here. It is convenient because it is close to our house,” Ms. Khoun explained. “I used to ask the agent if I can open my account with her. I want to save money, and I also want to have an ATM card. I feel that I don’t want to carry cash anymore. If I have a card, wherever I go I can withdraw money from the machine—that is what I want now. If we can open the account with BCOME, it would be wonderful,” she added.

BCOME is not only a solution for farmers to support their children’s education, it also allows them to have more opportunities to trade their products more broadly—helping them to break free of poverty. It helps farmers increase their income by providing a quick and easy payment system. BCOME responds directly to the needs of communities with a service that old-fashioned banking cannot provide. Siavone Phomavong, an agent in the capital city of Vientiane, shared an example: “I have a customer who sells organic vegetables. He sends money to buy them from farmers in Pakse, Champasak Province.” The BCOME service assists the growth of agribusinesses, as the money from buyers in the main cities flows out to farmers in the provinces, where the farmers can save and re-invest for better techniques and more productivity.

The access afforded by branchless banking does not only support education of farmers’ children and their agribusiness, it is also suited to many different types of business requirements, such as paying for insurance and making monthly payments for the purchase a car. Early adopters who have experienced the efficiency of the first branchless banking service in Lao PDR have greater understanding of the new system and value the system more. It benefits them in many ways, relieving stress in their lives and reducing the time and the cost of transactions, which in turn gives them a chance to save and thereby prepares them to take a first step out of the poverty trap.

In the future, BCOME will continue to grow with new product and service offerings and to play an important role in accelerating the growth of all kinds of businesses. The convenience and accessibility can be applied to any customer segment, from low-income populations who deal in small transaction amounts to large organizations that can network with people in any isolated region. These advancements will contribute to a greater number of people improving their livelihood by using a low-cost, easy and friendly system, which will drive the economy of the household and in turn the communities that form the core of the country’s wealth.

This is the second blog post of a series about the dawn of digital financial services in Lao PDR. Read also "Agents—The revolution on the ground in Lao PDR" for an agent's perspective.

June 2017. Copyright © UN Capital Development Fund. All rights reserved.

The views expressed in this publication are those of the author(s) and do not necessarily represent those of the United Nations, including UNCDF, or their Member States.

[1] Lao People’s Democratic Republic, Ministry of Education and Sports, Education and Sports Sector Development Plan (2016–2020) (Vientiane, December 2015).

[2] FinMark Trust and UNCDF-Making Access Possible, FinScope Survey Highlights: Laos 2014 (n.p., November 2015).

For more information, please contact:

Aliska Bajracharya

KM Consultant, Lao PDR

http://mm4p.uncdf.org

David Kleiman

DFS Expert in Lao PDR

Building digital financial service networks in Lao PDR

building multiple and varied relationships within this developing environment for digital financial services (DFS).

Digital finance expert David Kleiman shares insights from programmes with UNCDF

David Kleiman came to Lao PDR as a Digital Finance Expert from PHB Development for the United Nations Capital Development Fund (UNCDF) programme MMP4 in 2014. Since that time, David has focused on building multiple and varied relationships within this developing environment for digital financial services (DFS). He shared views on the objectives and impact of his work.

Can you briefly describe your core objectives to enable DFS?

In 2013, when UNCDF MM4P started, there was no regulatory framework or guidelines – and therefore no service providers either. In order to jump-start engagement, UNCDF MM4P applied a market-development approach to creating an ecosystem for DFS to take root and flourish in the country. Much of our success to date has come from a focus on three pillars of engagement:

David Kleiman, left, in Lao PDR

- A strong and growing relationship with the central bank, Bank of the Lao PDR (BoL), to develop guidelines and regulations for providers who aim to offer DFS and to promote a positive exchange between industry, BoL and the government in general.

- A direct strategic relationship with UNCDF partners – to promote, support and manage various project activities and to align their business objectives with UNCDF and BoL’s goals for financial inclusion.

- Broader stakeholder engagement with banks, microfinance institutions, Mobile Network Operators, and even startups to promote activity in the field of DFS.

When UNCDF provides support to enable implementation, partners also commit through their leadership and resource mobilization. It’s through these relationships with stakeholders that UNCDF can generate impactful projects and therefore catalyze the introduction of meaningful services for rural customers.

What can you say about the design and implementation process?

Any effective strategy must take into account the needs of people and the capacities of organizations in the country. Lao PDR currently has one implementation of DFS through agency banking; BCEL’s Community Money Express (BCOME), which allows people to do basic banking close to home. Before BCOME, customers had to travel to a bank branch – of which there are only 700 in the country. Today BCOME has more than 140 agents, so it represents both a turning point for the country and a significant improvement in the points of access for financial services. The upcoming launch by Unitel of their mobile wallet will add another significant dimension to the ecosystem.

What are some unique aspects of working with UNCDF on this?

Within Lao, UNCDF works jointly with BoL in a national implementation program called MAFIPP (Making Access to Finance more Inclusive for Poor People). This joint structure strengthens our communication with stakeholders and solidifies their commitment. Goals are aligned because of joint project nature, which can also help extend the use of DFS services to achieve aims such as enrolling in education, accessing better healthcare and more.

What are the changes you have seen, especially considering a human-centered design approach (HCD)?

In a new market like this, ambitions should be aligned before selling a financial service. It’s important to take demographics into account and to consider what really matters for the people – and why.

UNCDF has worked in numerous countries and has lots of talented people who understand best practices – particularly in engagement and impact. PHB Development has been working internationally with UNCDF on multiple DFS projects in Africa and Asia. The relationship between PHB and UNCDF is significant, and we can gain action-based insights from it. We listen to customers and providers who have aspirations – then work together to develop an implementation path based on best practices while developing services and solutions which are highly contextualized for each country.

MM4P AT A GLANCE

MM4P is a programme launched by UNCDF in partnership with the Swedish International Development Agency (Sida), the Australian Department of Foreign Affairs and Trade (DFAT), the Bill & Melinda Gates Foundation and The MasterCard Foundation. MM4P provides support to digital financial services (DFS) in a selected group of least developed countries (LDCs) to demonstrate how the correct mix of financial, technical and policy support can build a robust DFS ecosystem that reaches low-income people in LDCs.

For more information, visit mm4p.uncdf.org or follow @UNCDFMM4P and UNCDF MM4P on LInkedIn.

2 June 2017

Digital Financial Services: Bringing Stability to Small Farms so They Can Grow

The use of DFS such as agricultural microcredit can lead to key contributions in the improvement of value chains, from the timely acquisition of quality raw materials to the methods of storage and implementation.

How Digital Financial Services help smallholder farmers

Smallholder farmers are realising the benefits of on-demand digital financial services (DFS) to help improve farm resilience to unexpected conditions and to acquire funds for investing in better materials. As a result, many low-income farmers are increasing the consistency and quality of their yields – even as they conduct transactions while in the fields.

The use of DFS such as agricultural microcredit can lead to key contributions in the improvement of value chains, from the timely acquisition of quality raw materials to the methods of storage and implementation. Similarly, agricultural leases provide farmers with options to use helpful tools and products that would otherwise not be available to them.

And with increased yields, what about ensuring fair deals when selling their produce? Farmers can use digital agri-info systems that provide updates on current market prices – and weather forecasts – so they are equipped with this information before making transactions. DFS also allows buyers and sellers to make instant transactions, thus increasing trust and strengthening relations that benefit their farming business in the long run. Mobile Wallets – a way to use credit or debit card information on a mobile device – is a related service that provides a better sense of security when handling transaction funds in the presence of others.

DFS technology is even being used to mitigate emerging threats from nature. Microinsurance can provide a “safety net” for risks to farming, including from increasingly unpredictable weather patterns caused by climate change. Without such protection, farmers’ basic survival against uncontrollable elements can be less certain.

Financial and IT companies are increasingly working together to create digital financial products, such as MoKash, to optimise results for farmers who may operate near subsistence level to improve their livelihoods. The broader impact of these initiatives, as a result, becomes more visible in the overall economic improvement of the countries.

31 March 2017