Digital Credit

In Uganda, after the successful launch of MTN’s Mobile Money, they decided to expand their product offering by launching a digital credit and savings product, MoKash.

Ethical Lending in the Age of Digital Velocity and Scale

The so-called “too big to fail” banks of the financial crisis did fail, and not only to the tune of the trillions of dollars of negative impact[1] - they lost a significant amount of trust. Some of the “too big to fail” banks have recovered financially, but the industry is still failing to regain customer confidence[2]. In this environment, a narrative has emerged that fintech startups are in some way more ethical than big banks. Though there is no doubt that some fintechs can be more agile to address customers’ needs and can often scale faster than banks with certain offerings - nothing should imply that they are somehow more trustworthy than banks. This is particularly true when working with the unbanked populations of the developing world.

Throughout Asia and Africa, the need for low-value micro-loans has been met by any number of cash-based solutions. Traditionally, informal village savings groups, cooperatives or Microfinance Institutions (MFI) have filled this need. These localized institutions gain significant trust primarily due to their proximity to their customers and their ability to provide a relevant and appropriate credit offering. The products that they offer have not changed for decades, and they function reasonably well, but now we are faced with a new mantra in the microfinance space: Digitize or die.

In this hyper-competitive environment, Digital Credit and Peer-to-Peer (P2P) lending have exploded both in terms of people’s access to credit and their exposure to risks.

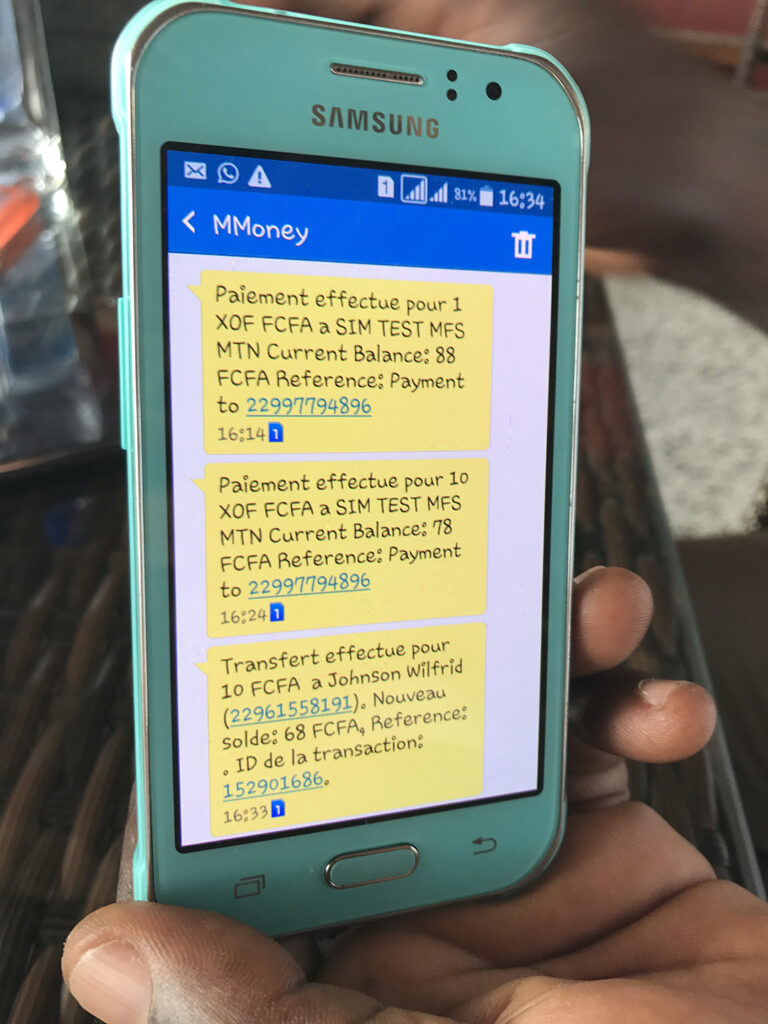

In Uganda, after the successful launch of MTN’s Mobile Money, they decided to expand their product offering by launching a digital credit and savings product, MoKash[3]. The avowed objective of the product is to increase MTN customer acquisition and retention, particularly in rural areas. This move aims to enable MTN Uganda to gain a competitive edge, ultimately strengthening its market position. One year after the launch, they had made 1 million loans at 9% per month disbursed for a total amount of UGX 30 billion (USD 8.3 million)

The assumptions at the launch of the service were that it would be beneficial and meet the expressed needs of people. However, research conducted by PHB Development for UNCDF identified that these were merely assumptions.[4] The research found gaps in the providers’ transparency and noted that customers often do not understand the products in terms of interest rate, cost of funds or delinquency consequences. Providers do not tend to recognize the cultural lag nor provide terms and conditions in simple language. Often entirely omitting a chance for clients to read the terms which are referred to via a web link - when a majority of customers are using feature phones with no internet access.

Most countries where digital credit is common are unable to benefit from a credit bureau that can be used to check whether customers already have similar loans or other types of loans, and customers thereafter face the risk of being blacklisted for overdue loans of small amounts of money. Customers have also reported the need to take out additional loans in order to pay for the previous one – leading to a cycle of indebtedness that is difficult to break. As John Oliver[5] mentioned years ago about a similar problem with payday loans in the USA - this form of credit “is the Lay’s potato chip of financial services. It is bad for you, and it is impossible to eat just one.”

Be that as it may, people in almost equal numbers agree that they needed the loan and it made their lives better, and conversely that they regret taking the loan.

But nowhere else perhaps is that regret higher than in China, the previously largest P2P market in the world. In 2016, when the Ezubao P2P scandal was revealed, 900,000 people collectively had lost US$7.6 billion in what was the second-largest Ponzi scheme in the world – and the largest financial crime in China at that time. At the time, this was considered by many to be “one bad apple”, but in the intervening years, more frauds associated with P2P had emerged. Finally, in October 2019, customer protection regulation has been put in place[6] and includes interest rate limits, disclosure policies and reporting and monitoring mechanisms– but it took more than three years to implement the regulations and left many customers and investors exposed.

In both cases of digital credit and P2P lending, we can see how the trend to ease the access to nano credit has been welcome in the market and exacerbated some of the risks. Of course, these businesses aspire to grow, and they know that trust will be essential. In the fintech area, the most significant factor to indicate trust may well be an established, large and visible brand in the market. This quest for scale - especially when it relates to lending - might be the source of some of the ethical dilemma.

While trying to look large and promote an image of trust, fintechs may often pay only lip service to transparency, privacy, accountability. Though there is much to be said about Human-centered design in financial inclusion - there may be no easy fix to smooth out the cultural lag that occurs when we introduce relatively complex lending products via a digital channel in rural communities. For Fintechs or MFIs who must “digitize or die”, they would be well advised to consider how to manage these societal risks, often outside of slow-moving regulation, so that both they and their customers can thrive.

[1] Stacy Curtin, “2008 Financial Crisis Cost Americans $12.8 Trillion: Report”, Yahoo Finance September 2012

[2] Katherine Seltzer, “Consumer confidence in banking on the decline”, S&P Global, June 2019

[3] MTN has partnered with the Commercial Bank of Africa Uganda (CBA) while drawing inspiration from M-Shwari in Kenya, a similar product from a partnership between Safaricom M-PESA and CBA Kenya.

[4] https://phbdevelopment.com/wp-content/uploads/2019/11/PHB-Toolkits-6.pdf

[5] https://www.youtube.com/watch?v=PDylgzybWAw

[6] Zhou Xin, China crackdown on private lending, South China Morning Post October, 2019

For more information, contact David Kleiman

Feature Image source: CGAP

Rural Development & Financial Inclusion

People in rural and low-income areas can now open new economic opportunities to participate in even basic systems which they previously could not access.

Alone no more: Rural Communities finding Financial Inclusion

Not so long ago, rural communities far away from urban centres of business were left with few external resources to build their economic activity and raise standards of living. This scenario has changed.

People in rural and low-income areas can now open new economic opportunities to participate in even basic systems which they previously could not access. An increasing number of microfinance institutions (MFIs) and other financial inclusion services are catering to the poor in rural areas and empowering people to provide for their own needs and to rise from impoverished situations.

The results are communities that are more productive and less vulnerable to natural and human risks. Safer housing structures, engagement in education, access to health care, and improved water/sanitation facilities are some benefits that are resulting.

Services such as small loans that enable basic entrepreneurship are simple operations with far-reaching impacts on the local economic cycle. Credit services are tailored for different consumers to meet their needs:

- Agriculture leases (helping farmers endure low seasons and thrive in good seasons)

- Education loans (investing in the future of the communities as a whole)

- Consumer loans (building potential for a healthy local exchange)

- Housing loans (enabling a more secure existence for families)

Remittance services are also popular in rural areas for family members to regularly transfer money to each other. Women, youth and the disabled are benefitting in particular from modern systems, as these groups may have been previously deprived of financial services and resulting earning opportunities.

Digital financial services (DFS) enable business transactions that also save users from the time and cost of travel to financial institutions. The savings accounts offered by MTN MoKash and Airtel Wewolw are examples of services with which people can save and access their money through mobile wallets without worrying about security issues.

Of course, there are risks for MFIs from issues such as high default rates that may discourage some providers. Making a positive social impact in challenging situations requires a certain level of commitment and expertise, and PHB Development is glad to be a leader in this sector of enabling low-income rural areas to become more prosperous and resilient.

Digital Financial Services: Bringing Stability to Small Farms so They Can Grow

The use of DFS such as agricultural microcredit can lead to key contributions in the improvement of value chains, from the timely acquisition of quality raw materials to the methods of storage and implementation.

How Digital Financial Services help smallholder farmers

Smallholder farmers are realising the benefits of on-demand digital financial services (DFS) to help improve farm resilience to unexpected conditions and to acquire funds for investing in better materials. As a result, many low-income farmers are increasing the consistency and quality of their yields – even as they conduct transactions while in the fields.

The use of DFS such as agricultural microcredit can lead to key contributions in the improvement of value chains, from the timely acquisition of quality raw materials to the methods of storage and implementation. Similarly, agricultural leases provide farmers with options to use helpful tools and products that would otherwise not be available to them.

And with increased yields, what about ensuring fair deals when selling their produce? Farmers can use digital agri-info systems that provide updates on current market prices – and weather forecasts – so they are equipped with this information before making transactions. DFS also allows buyers and sellers to make instant transactions, thus increasing trust and strengthening relations that benefit their farming business in the long run. Mobile Wallets – a way to use credit or debit card information on a mobile device – is a related service that provides a better sense of security when handling transaction funds in the presence of others.

DFS technology is even being used to mitigate emerging threats from nature. Microinsurance can provide a “safety net” for risks to farming, including from increasingly unpredictable weather patterns caused by climate change. Without such protection, farmers’ basic survival against uncontrollable elements can be less certain.

Financial and IT companies are increasingly working together to create digital financial products, such as MoKash, to optimise results for farmers who may operate near subsistence level to improve their livelihoods. The broader impact of these initiatives, as a result, becomes more visible in the overall economic improvement of the countries.

31 March 2017

MoKash is Calling Up a Future of Mobile Financial Possibilities in Uganda

MoKash is helping more than a million subscribers when and where they need to meet opportunities and demands that require ready access to money.

How Mokash is helping

Students, farmers, and small business owners in Uganda are discovering a user-friendly way to access loans and build savings through mobile phones. Launched in August 2016, MoKash is helping more than a million subscribers when and where they need to meet opportunities and demands that require ready access to money.

Customers can build savings in small amounts over their phone with the Commercial Bank of Africa (CBA), as well as borrow money almost immediately when needed, provided they have been using the MTN mobile network for at least 6 months. MoKash also features less waiting time for loan application approval through the use of artificial intelligence in processing history checks. For savings, the MoKash deposit account enables customers to earn up to 5% interest on amounts that can be built up with an auto-save function to prepare for business, education, and unexpected needs. “It’s a good way of saving and accessing loans with improved security,” said Edward Oyam, businessman.

The Mokash MTN Product

This innovative cash management product is operated with the support of the United Nations Capital Development Fund (UNCDF) and Mobile Money for the Poor (MM4P) – in collaboration with the consulting firm PHB Development. The implementing organizations MTN Uganda and its partner, the CBA, aim to provide low-income people with access to financial services that can make a positive impact on their livelihoods. As a result, a growing range of customers are benefitting from an easily-accessible approach to mobile financial services:

- Quick access to loans allows parents and students to borrow money when needed to pay for education fees and materials.

- Customers avoid the transport cost and time to visit a bank, enabling broader groups of people, especially in rural areas, to be economically productive.

- MoKash allows individuals to take out loans without needing to be within a group, and without extensive collateral requirements.

On MoKash and the future, Brenda Oyam, student, said, “I need loans for school fees and emergencies, but I would also like to save small amounts…I hope to use it to improve my life.”

21 March 2017