Support the digitalization of WFP cash transfers in Niger

The development of training curricula based on the results of the study and the conduct of training sessions for trainers with WFP's operational partners (NGOs, etc.)

Context:

In November 2017, WFP and UNCDF signed a Memorandum of Understanding specifying the synergies to be put in place between the two organizations for the accomplishment of their respective missions in West Africa. It is in this context that a project was initiated in 2018 between WFP Niger and the MM4P program. The objective of this project is to support WFP Niger in digitizing its social cash transfers to households in vulnerable situations.

Objectives:

PHB was selected to implement the process of digitizing payments of social transfers. More specifically, the objectives were to conduct studies and research that will enable WFP to acquire a good knowledge of the behaviour and attitudes of its beneficiaries, and also to effectively apprehend their needs in order to implement the most appropriate solutions taking into account their immediate environment (geographical, cultural and socio-economic). PHB shall conduct an evaluation of the distribution network selected, in order to highlight the strengths and weaknesses for which the improvement and correction plans should be implemented to ensure the success of the transfer operations.

Deliverables:

- Conducting a human-centred study to better identify the needs and constraints in terms of adoption and use of digital financial services, which will have to be addressed later through adequate training;

- Evaluation of the DFS provider agent network in the project area and discuss the value proposition of the financial service provider

- The development of training curricula based on the results of the study and the conduct of training sessions for trainers with WFP's operational partners (NGOs, etc.)

Development of the digital finance strategy in Ivory Coast

The payment sector in Côte d'Ivoire gives large importance to the digital payments instruments. However, it must adapt to the arrival of new players, new technologies and changing user expectations. In 2014, Côte d'Ivoire adopted the Financial Sector Development Strategy to reorganize, stabilize and develop the sector. This strategy is broken down into a sectoral and thematic action plan. The Financial Sector Development Program (PDESFI), created in 2014 by the Government, is the body responsible for implementing the strategy.

Context:

The payment sector in Côte d'Ivoire gives large importance to the digital payments instruments. However, it must adapt to the arrival of new players, new technologies and changing user expectations. In 2014, Côte d'Ivoire adopted the Financial Sector Development Strategy to reorganize, stabilize and develop the sector. This strategy is broken down into a sectoral and thematic action plan. The Financial Sector Development Program (PDESFI), created in 2014 by the Government, is the body responsible for implementing the strategy.

Objectives:

As part of its mission, and in order to accelerate the development of the digital finance sector, PDESFI wished to develop a strategy for the development of digital finance. The definition of a strategy for the development of digital finance aims to accelerate the development and securing of innovative means of payment and the competitiveness of the Ivorian payments industry.

Deliverables:

- Review documentary: PESTLE analysis on the situation of digital finance in Côte d'Ivoire; Comparative study of Côte d'Ivoire and other relevant countries; Research tools (questionnaires) and stakeholder mapping

- In-depth interviews with industry stakeholders: 30 stakeholder interviews (government, private sector, and international agencies)

- Preparation of the strategy document: Development of the national strategy framework for the Ivory Coast by clearly identifying the status and future needs of each element of the digital finance ecosystem: policies and regulations, distribution, providers, partners, clients, networks of agents and levers of adoption; Development of the work plan for the implementation of the country strategy (with activities, and calendar over 5 years and working budgets) ; Results Chain Project ; Framework for measuring results and the results chain ; Stakeholder strategy presentation workshop

Implementation of airtime top-up services to pay for micro-insurance and micro-pension

In 2017, The Solomon Islands National Provident Fund (SINPF), with support from PFIP, piloted a retirement savings product for the informal sector known as youSave. One of the pilot recommendations was to utilise cost-effective digital delivery channels to allow for direct remittance of savings into SINPF. Because of the inefficiencies and a lack of reach into the rural areas by existing digital payment channels, the option to use airtime was recommended. The staggering cost of Airtime distribution in the Solomon Islands seemed to be an insurmountable challenge in order to achieve a sustainable business case for payment collections PHB was previously engaged to conduct a feasibility assessment and based upon that positive outcome this project was initiated to implement the youSave Lo Mobile service - and launch the world’s first-ever airtime scheme for provident fund payments.

Context:

In 2017, The Solomon Islands National Provident Fund (SINPF), with support from PFIP, piloted a retirement savings product for the informal sector known as youSave. One of the pilot recommendations was to utilise cost-effective digital delivery channels to allow for direct remittance of savings into SINPF. Because of the inefficiencies and a lack of reach into the rural areas by existing digital payment channels, the option to use airtime was recommended. The staggering cost of Airtime distribution in the Solomon Islands seemed to be an insurmountable challenge in order to achieve a sustainable business case for payment collections PHB was previously engaged to conduct a feasibility assessment and based upon that positive outcome this project was initiated to implement the youSave Lo Mobile service - and launch the world’s first-ever airtime scheme for provident fund payments.

Objectives:

The objective of this project was to implement the youSave Lo Mobile service in a seamless and ubiquitous manner. Specifically to assure the same user interface across all MNOs and to maintain clear reporting back to the SINPF, CBSI, and Tax Authority as required.

Deliverables:

- Bring together all stakeholders (MNOs, SINPF, Central Bank and the Tax authority) to agree upon all business terms, settlement and reconciliation of accounts, and all reporting to each other as agreed. Specifically, to identify ways to share the cost of distribution through tax alleviation.

- Establish consensus on marketing to assure consistency of messaging and communications across both MNOs and the SINPF; this included getting a commensurate level of contribution from each MNO to promote the service

- Establish IT and technology links to allow a seamless service to operate and deliver a consistent service to the customer. This included making sure that the USSD menu and SMS messaging were similar.

- Work directly with SINPF to develop a mobile application for the onboarding of new youSave customers, this included coordinating with internal and external IT resources and developing appropriate compensation schemes.

TA Digital Credit for Dairy & Agriculture microentrepreneurs

In the year 2018, Nepal transitioned to a late start-up stage with rapid expansion in the agent network, registered and active users and use-cases to drive digital payments. Leveraging the data on farmers’ income, their transaction history on the wallet and lastly the inwards remittance received by most farmers from relatives abroad or living in cities, UNCDF and Prabhu Pay designed and signed a project to extend digital credit to cooperative farmers.

Context:

In the year 2018, Nepal transitioned to a late start-up stage with rapid expansion in the agent network, registered and active users and use-cases to drive digital payments. Leveraging the data on farmers’ income, their transaction history on the wallet and lastly the inwards remittance received by most farmers from relatives abroad or living in cities, UNCDF and Prabhu Pay designed and signed a project to extend digital credit to cooperative farmers.

Objectives:

- The objectives of the assignment are:

- Defining the digital credit process and risk management mechanisms.

- Develop a requirement specification document and a logic workflow for credit scoring solution.

- Define the parameters for credit assessment based on a thorough statistical assessment of data quality and data strength available at different sources. Also, establish a mechanism for regular update/upgrade of the tool.

- Develop/Install the credit scoring tool (open to emerging technology such as shared ledger) and support Prabhu Management IT team pilot it.

- Review of the credit assessment tool after 6 months of the pilot

Deliverables:

- Project Set up – deliverables: Kick-off meeting and the minutes.

- Definition of the customer journey – deliverables: Customer Journey, Presentation Process Flow Document, Risk Management Document.

- Definition of the requirements and data source determination – deliverables: Requirement Specification, Logic/Work Flow document for digital credit.

- Data preparation and model development – deliverables: Develop the template for data collection.

- Credit Scoring Installation and Automation – deliverables: Develop/Install a credit scoring tool integrated with different sources for fetching data, loan origination and score.

- review of the pilot – deliverables: Pilot report

PFIP P2G Samoa

The Land Transport Authority (LTA) of the Samoa Government is managed within the Ministry of Works, Transport and Infrastructure. LTA is the principal licensing authority for all forms of land transportation in the country and has three main revenue streams including Drivers Licensing, Registration and Tickets for traffic offences. Payment flows are typical to meet the Authority’s operational activities in meeting its core functions identified above. A significant proportion of payment flows (person to LTA) are via cash and business cheques.

Context:

The Land Transport Authority (LTA) of the Samoa Government is managed within the Ministry of Works, Transport and Infrastructure. LTA is the principal licensing authority for all forms of land transportation in the country and has three main revenue streams including Drivers Licensing, Registration and Tickets for traffic offences. Payment flows are typical to meet the Authority’s operational activities in meeting its core functions identified above. A significant proportion of payment flows (person to LTA) are via cash and business cheques.

Objectives:

- Identify and map out all existing payment flows from customers to LTA looking at the frequency, payment mode, volumes and values to present the overall big picture.

- Assist LTA in evaluating its costs of transactions, estimated efficiency losses and other impacts of continuing with the present heavily cash-based transaction platform.

- Assess the capability of the LTA IT and business systems as to the readiness of these to support digital payments and changes if any required.

- In conjunction with the LTA legal team study the existing LTA Act 2007 and regulations and look at options to make all payments from customers to LTA compulsorily using digital channels.

Deliverables:

- Produce evidence-based payment flows map covering all types of payment transactions from customers to LTA including the type, frequency, amounts, mode of these payments together with any other pertinent information for assessing payment flows;

- Legal/regulatory changes required for LTA to make all its customer payments compulsorily digital;

- Possible digital payment solutions with suggested partners to work with;

- Evidence-based assessment of the readiness of LTA IT and business systems and processes to accept and properly account for digital payments received, together with recommendations relating to upgrade/changes (if any required);

- Approximate costs and budgets for moving to digital payment channels

Support UNCDF In The Development Of The DFS Ecosystem In LAO PDR

In Lao PDR, UNCDF Making Access to Finance More Inclusive for Poor People (MAFIPP) is a UNCDF sector support programme in partnership with the Bank of Lao PDR (BOL) which seeks to improve access of poor rural households to a variety of financial services and markets, improving rural household incomes.

Context: In Lao PDR, UNCDF, in partnership with the Bank of the Lao PDR (BoL) sought to improve and catalyze access of rural households to vital financial services and markets through the development of a digital finance ecosystem.

Objective: To embed a UNCDF DFS Expert capable to provide support to BoL and a wide range of Branchless Banking and DFS stakeholders to jump-start the ecosystem in this greenfield market. Conduct all marketing and communication activities (studies, strategy, plans, design, implementation, testing and roll-out) for pilot projects with BCEL (Banque Pour Le Commerce Exterieur - the largest bank in Laos), and Unitel, the dominant mobile operator in the country. Engage with all other stakeholders including Government, MFIs, Fintech Start-ups and promote partnership and collaboration through the animation of a Digital Finance Working Group chaired by BoL.

Deliverables: Program coordination, reporting and market development; Knowledge raising and capacity building; Product development; Agent network development; Regulatory policy support, capacity building and training.

For More Details about PHB’s groundbreaking work in Laos, see the multi-media case study, Dawn of Digital Finance in Lao PDR

Deploy Mobile Financial Services Business Model for MFIs in the Philippines

Scaling Innovations in Mobile Money (SIMM) is a 2-year USAID project to scale the uptake of mobile money adoption and usage in the Philippines.

Context: Scaling Innovations in Mobile Money (SIMM) is a 2-year USAID project to scale the uptake of mobile money adoption and usage in the Philippines.

Objective: Reduce operating costs of MFIs in loan disbursement and collections of loan amortization, microinsurance premiums, savings; Increase loan officers productivity, expand outreach, offer new products or services.

Deliverable: Draft MFS business model, Pilot implementation and finalize MFS business model.

Value Proposition Mapping of the Dairy Value Chain, Uganda

For Digital Financial Services (DFS) payments to be sustainable, each of the businesses and individuals involved must have a sound financial motive for continuing to participate.

Context: For Digital Financial Services (DFS) payments to be sustainable, each of the businesses and individuals involved must have a sound financial motive for continuing to participate. Value proposition mapping can help determine if, and to what extent, there is value in digitizing payments as perceived by relevant actors.

Objective: In the context of the dairy value chain in Uganda, the project aims to: 1) Estimate the costs and benefits of utilizing DFS 2) Identify pain points in the delivery and use of DFS 3) Propose an implementation plan that will capitalize on the value propositions faced by smallholders, agribusinesses, and financial service providers.

Deliverables: 1)Detailed research work plan 2) Excel VPM models with findings 3) Slide deck summarizing all findings 4) Final report 5) Pilot implementation plan 6) Publishable blog

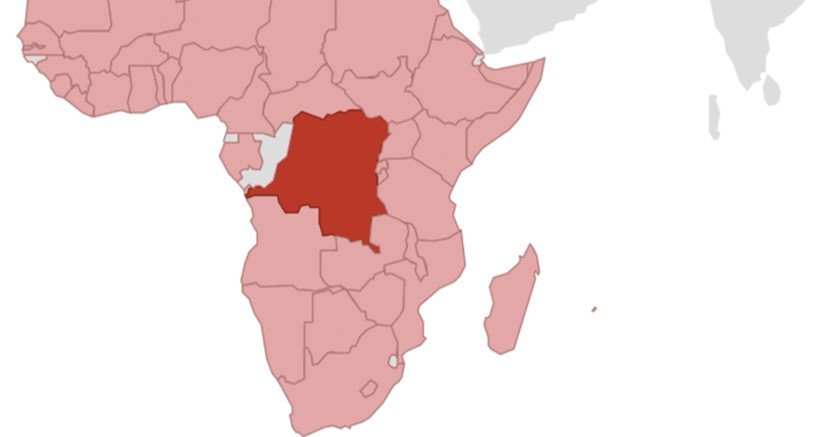

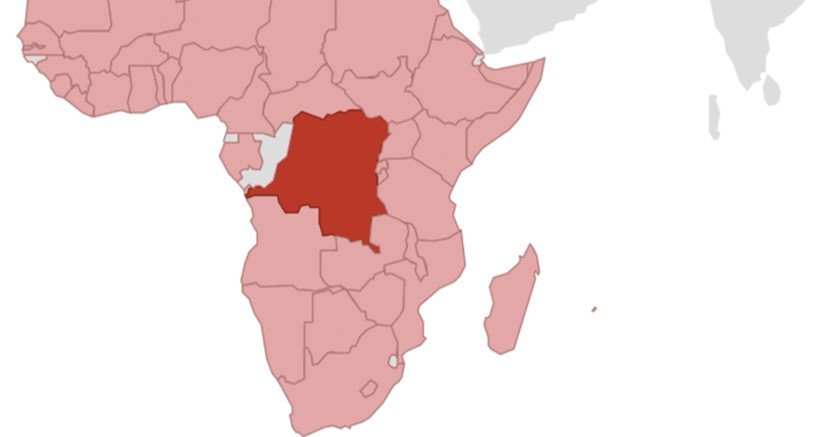

Development of digital credit and savings product for a Microfinance Institute (MFI) in the Congo (DRC)

The MFI in DRC – in partnership with a mobile network operator (MNO) – is willing to launch a digital savings and loans product. The MFI is supplying its credit license and manages the savings and credit risk. The MNO is also providing its customer base and its agent network.

Context: The MFI in DRC – in partnership with a mobile network operator (MNO) – is willing to launch a digital savings and loans product. The MFI is supplying its credit license and manages the savings and credit risk. The MNO is also providing its customer base and its agent network.

Objective: This product will enable instant credit scoring capabilities based on algorithms using enterprise and mobile data sources. One key data set considered will be the customers’ savings behaviors, which is expected to encourage customers to save with the MFI and therefore to mobilize savings, reducing the cost of funding for the institution. The core objective of the involved MNO for the digital credit and savings product is to increase customer acquisition and retention as a means of improving access and provision to affordable alternatives for customers, particularly those in rural areas.

Deliverables: 1) Market research: Perform desk review, Human-Centric Design (HCD) interviews and focus groups to understand client challenges. 2) Product design phase: Help prioritize product features based on customer insights. 3) Go-to-market definition: Define positioning and customer segmentation and elaborate value proposition. 4) Customer experience and product flow prototyping: Conduct Focus groups discussion/prototyping sessions to test early product features. 5) Business case elaboration: Gather Data and elaborate Business modeling and perform sensitivity analysis. 6) Preparation of pilot: Prepare Pilot Roll-out Plan

Evaluate scaling-up financial services delivery program

In cooperation with The MasterCard Foundation, the International Finance Corporation (IFC) is implementing a program intended to accelerate the reach of financial services for the poor in sub-Saharan Africa, through two main workstreams.

Context: In cooperation with The MasterCard Foundation, the International Finance Corporation (IFC) is implementing a program intended to accelerate the reach of financial services for the poor in sub-Saharan Africa, through two main workstreams. The first aims to support significant scaling up of reach and diversification of product offerings of eight of IFC’s strongest microfinance partners, with an additional two funded under a separate window from the Development Bank of Austria, for a total of 10 MFIs supported by the program. The second focuses on assisting banks and/or mobile network operators to offer financial services at significant scale using alternative delivery channels (ADCs) such as agent and mobile banking channels

Objective: The evaluation will provide the IFC Sub-Saharan Africa Office, the Access to Finance (A2F) Business Line, the MasterCard Foundation and the participating institutions (mainly MFIs and MNOs) with sufficient information to: Make an independent assessment both at mid-term and ex-post about the performance of the Partnership; Identify key lessons and propose recommendations for course correction and follow-up actions; Assess the effectiveness of the Knowledge Management component of the Partnership. Specifically, the paper will analyze how MFIs implement MFS channels with the goal to achieve profitable growth, and document the primary operational and institutional challenges of implementing new channels and key issues for MFIs to consider.

Deliverables: 1a) A theory-based, process orientated mid-term Evaluation of the IFC-MasterCard Foundation Partnership. This Evaluation addresses 5 evaluation criteria: four standard OECD-DAC criteria (relevance, effectiveness, efficiency, and sustainability), as well as the standard IFC dimension of additionality. The main aim of this study is to provide recommendations for timely course corrections. 1b) A theory-based, summative final Evaluation of the IFC-MasterCard Foundation Partnership. This Evaluation addresses 6 evaluation criteria: five standard OECD-DAC criteria (relevance, effectiveness, efficiency, impact and sustainability), as well as the standard IFC dimension of additionality. 2) Business Case study for MFIs implementing ADCs with the goal to achieve profitable growth. The study collects data, analyze and document the evolution of ADC implementations over the course of their participation in the scaling program.