Study and recommendations for regulators to drive the digital transformation of microfinance in Africa

The intersection of digital technologies and microfinance is one of the focus areas of AFI, especially given the opportunities technology provides in enhancing microfinance institutions (MFIs), at the MFI level (improved efficiency, reduced costs, etc.) and at the customer level (convenience, digital footprint, etc.). AFI commissioned this study to provide more efficient and relevant guidance to its members (financial regulators and supervisors) in the area of digitization of microfinance services.

Context:

The intersection of digital technologies and microfinance is one of the focus areas of AFI, especially given the opportunities technology provides in enhancing microfinance institutions (MFIs), at the MFI level (improved efficiency, reduced costs, etc.) and at the customer level (convenience, digital footprint, etc.). AFI commissioned this study to provide more efficient and relevant guidance to its members (financial regulators and supervisors) in the area of digitization of microfinance services.

Objectives:

The objective of this study is to underscore the role of technology in enhancing, efficiency and viability of the microfinance industry in Africa. It seeks to understand the synergy between digital financial services and microfinance institutions and develop policy and regulatory recommendations that facilitate the digital transformation of microfinance services to deepen financial inclusion in Africa.

Deliverables:

- Production of outline and methodology for the study

- Literature review

- 10+ stakeholder interviews among MFIs, MNOs, and Fintechs

- Report writing and publication

Digital Transformation of Microfinance and Digitization of Microfinance Services to Deepen Financial Inclusion in Africa

Understand the synergy between digital financial and microfinance institutions in providing access to finance to individuals and small businesses

Context: Understand the synergy between digital financial and microfinance institutions in providing access to finance to individuals and small businesses

Objective: The overall objective of this consultancy assignment is to underscore the role of technology in enhancing, efficiency and viability of the microfinance industry in Africa.

Deliverable: Created a report on the digital transformation of microfinance and digitization of microfinance services to deepen financial inclusion in Africa. Developed policy and regulatory recommendations that facilitate the digital transformation of microfinance services to deepen financial inclusion in Africa and pave the way toward the advancement of strategic collaboration for AFI and its partners in the Africa region

Context: Review the market in West Bank for establishing and engaging a banking services company. The remit of this company would include the operation of a national switch and management of the POS and merchant acquiring.

Objective: Assess the payments landscape in Palestine and advise on how technology could cost-effectively enhance the reach of banking and payment products.

Deliverables: Produced report addressing the future of financial inclusion and recommendations on how to expand the service at POS; create a national and interoperable switch and prevent information asymmetries that limit access to credit.

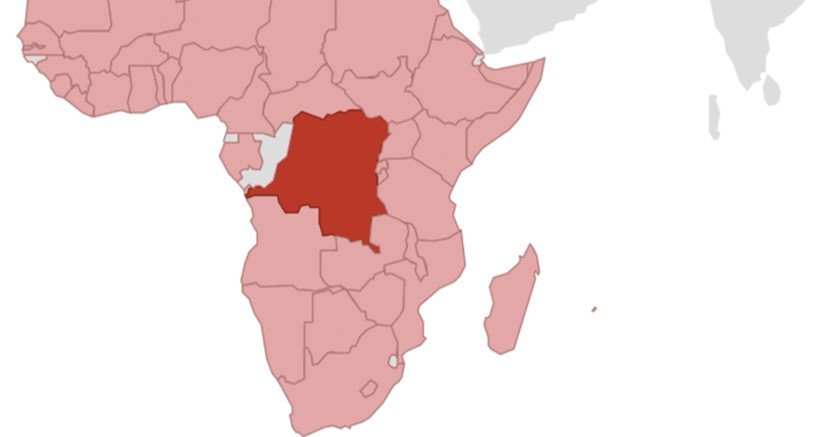

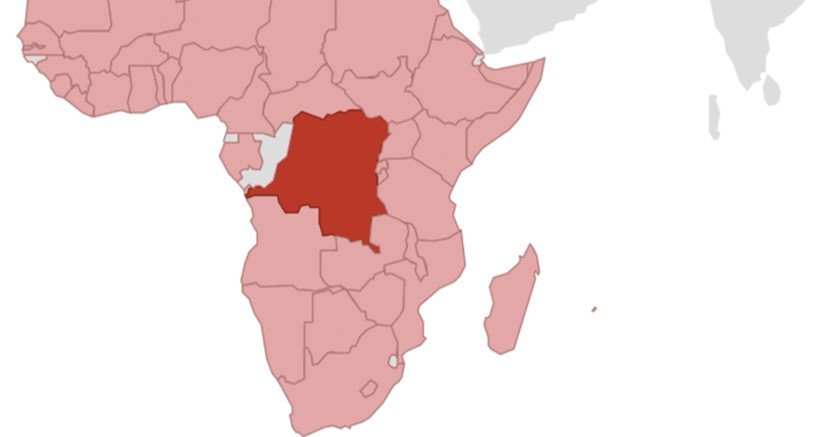

Development of digital credit and savings product for a Microfinance Institute (MFI) in the Congo (DRC)

The MFI in DRC – in partnership with a mobile network operator (MNO) – is willing to launch a digital savings and loans product. The MFI is supplying its credit license and manages the savings and credit risk. The MNO is also providing its customer base and its agent network.

Context: The MFI in DRC – in partnership with a mobile network operator (MNO) – is willing to launch a digital savings and loans product. The MFI is supplying its credit license and manages the savings and credit risk. The MNO is also providing its customer base and its agent network.

Objective: This product will enable instant credit scoring capabilities based on algorithms using enterprise and mobile data sources. One key data set considered will be the customers’ savings behaviors, which is expected to encourage customers to save with the MFI and therefore to mobilize savings, reducing the cost of funding for the institution. The core objective of the involved MNO for the digital credit and savings product is to increase customer acquisition and retention as a means of improving access and provision to affordable alternatives for customers, particularly those in rural areas.

Deliverables: 1) Market research: Perform desk review, Human-Centric Design (HCD) interviews and focus groups to understand client challenges. 2) Product design phase: Help prioritize product features based on customer insights. 3) Go-to-market definition: Define positioning and customer segmentation and elaborate value proposition. 4) Customer experience and product flow prototyping: Conduct Focus groups discussion/prototyping sessions to test early product features. 5) Business case elaboration: Gather Data and elaborate Business modeling and perform sensitivity analysis. 6) Preparation of pilot: Prepare Pilot Roll-out Plan

Evaluate scaling-up financial services delivery program

In cooperation with The MasterCard Foundation, the International Finance Corporation (IFC) is implementing a program intended to accelerate the reach of financial services for the poor in sub-Saharan Africa, through two main workstreams.

Context: In cooperation with The MasterCard Foundation, the International Finance Corporation (IFC) is implementing a program intended to accelerate the reach of financial services for the poor in sub-Saharan Africa, through two main workstreams. The first aims to support significant scaling up of reach and diversification of product offerings of eight of IFC’s strongest microfinance partners, with an additional two funded under a separate window from the Development Bank of Austria, for a total of 10 MFIs supported by the program. The second focuses on assisting banks and/or mobile network operators to offer financial services at significant scale using alternative delivery channels (ADCs) such as agent and mobile banking channels

Objective: The evaluation will provide the IFC Sub-Saharan Africa Office, the Access to Finance (A2F) Business Line, the MasterCard Foundation and the participating institutions (mainly MFIs and MNOs) with sufficient information to: Make an independent assessment both at mid-term and ex-post about the performance of the Partnership; Identify key lessons and propose recommendations for course correction and follow-up actions; Assess the effectiveness of the Knowledge Management component of the Partnership. Specifically, the paper will analyze how MFIs implement MFS channels with the goal to achieve profitable growth, and document the primary operational and institutional challenges of implementing new channels and key issues for MFIs to consider.

Deliverables: 1a) A theory-based, process orientated mid-term Evaluation of the IFC-MasterCard Foundation Partnership. This Evaluation addresses 5 evaluation criteria: four standard OECD-DAC criteria (relevance, effectiveness, efficiency, and sustainability), as well as the standard IFC dimension of additionality. The main aim of this study is to provide recommendations for timely course corrections. 1b) A theory-based, summative final Evaluation of the IFC-MasterCard Foundation Partnership. This Evaluation addresses 6 evaluation criteria: five standard OECD-DAC criteria (relevance, effectiveness, efficiency, impact and sustainability), as well as the standard IFC dimension of additionality. 2) Business Case study for MFIs implementing ADCs with the goal to achieve profitable growth. The study collects data, analyze and document the evolution of ADC implementations over the course of their participation in the scaling program.

Urwego Opportunity Bank (UOB) Branchless Banking (mHOSE) Evaluation – Rwanda

UOB launched in 2013 mobile and agent (branchless) banking (mHOSE) for its customers to have better access to UOB savings accounts, allow repayments of loans via the mobile phone, and to offer benefits such as a life insurance and the capacity to transfer money and pay bills, using the mVISA platform.

Context: UOB launched in 2013 mobile and agent (branchless) banking (mHOSE) for its customers to have better access to UOB savings accounts, allow repayments of loans via the mobile phone, and to offer benefits such as a life insurance and the capacity to transfer money and pay bills, using the mVISA platform. Triple Jump (TJ) wants to evaluate the effects of branchless banking products on an MFI and its clients so that TJ can use the findings to showcase the benefits and promote the use of branchless banking. UOB’s mHOSE was selected as the MFI to test out the Branchless Banking Diagnostic Tool that was developed by PHB in consultation with TJ.

Objective: The objective was to evaluate the effects of branchless banking (BB) for the MFI: Cost of implementation and service delivery; Operational efficiency gains and safety of staff and cash; Rural outreach and clients satisfaction; Portfolio quality and profitability The other objective for the clients: Cost of accessing products and services; Service quality and customer satisfaction; Social and financial inclusion

Deliverables: Designing the Evaluation matrix and the Diagnostic Tool (for the MFI and for clients); Data collection on the indicators listed in the matrix. Methods used were data mining based on the MIS, interviews with management and staff, focus group discussions and a telephone survey (with 400 clients); Analysis of outputs and results, including the completing the Diagnostic Tool; Formulation of recommendations to improve mHOSE and a prioritization, In close cooperation with UOB; Writing of the detailed case-study and the executive summary (for an article to be published).