Interoperability – Unlocking Inclusive Digital Economies

Interoperability – Unlocking Inclusive Digital Economies

Meet Espoir – a Senegalese street vendor – who would like to get paid by his customers through mobile money. However, to enable any customer to make payments digitally, he currently has to open as many accounts as there are digital financial service providers in the market (currently 12). This is because mobile money providers are not yet interoperable.

The rise of new technologies has attracted so many new players (mobile money issuers, aggregators and fintechs) and given rise to diversified products and payment methods (mobile money, agent networks, online banking). This has not always been a good thing. With each provider operating in a “walled garden” – customers are unable to transact with customers of other providers. And not only that, there is a risk of large providers gaining market share at the cost of smaller ones. This could increase the price, reduce quality and limit the growth of financial services.

Without interoperable digital financial services in West Africa, the goal of achieving a 75% financial inclusion rate will be difficult to achieve. For this reason, in 2017, the Central Bank of West African States (BCEAO) committed to the establishment of an interoperable payment platform for all financial service providers in the 8-country region. The system will allow financial transactions between all types of accounts (banks, microfinance, mobile network operators and other e-money issuers), and is meant to include all payment channels such as cards, mobile, internet, ATMs, points of sale.

The benefits of interoperability of digital financial services are manifold, ranging from boosting competition by levelling the playing field, reducing barriers to entry, stimulating innovation and diversifying the basket of products. Interoperability leads to better performance for financial institutions and greater freedom in the use of services for the end-user. While for BCEAO, it controls risks and will contribute to effective supervision of the payment system.

That being said, interoperability is a complex and multidimensional puzzle, which is why examples of successful implementation in financial inclusion are scarce. But BCEAO’s commitment to making this happen is shepherding the whole industry to get on board.

Ownership vs Participation

The level of interoperability envisioned by BCEAO is an unprecedented effort due to its scale and regional scope. Nowhere else in the world has such a project – bringing together 800 institutions across eight countries to cover a target market of 120 million inhabitants – seen the light of day. Lack of precedent often brings innovation, but also, potentially, risk. The BCEAO team started the project with excitement and caution.

After an initial consultation phase, BCEAO quickly understood the reluctance of some in the sector who feared the loss of their competitive advantage, and others who contemplated the immense effort to put their teams and systems at the helm of the interoperable system.

Experience with implementing interoperability at the national level confirms that an essential prerequisite is the ownership, involvement and adherence to the project objectives by all stakeholders – particularly financial service providers.

To implement a genuinely participatory approach to the initiative, BCEAO called in Deloitte, PWC and PHB. While PWC assessed the market for digital financial services and the capacity of GIM UEMOA to manage the system, Deloitte managed a set of thematic working groups. PHB designed and delivered the training component.

PHB as catalysts: Building capacity to contribute and the will to implement

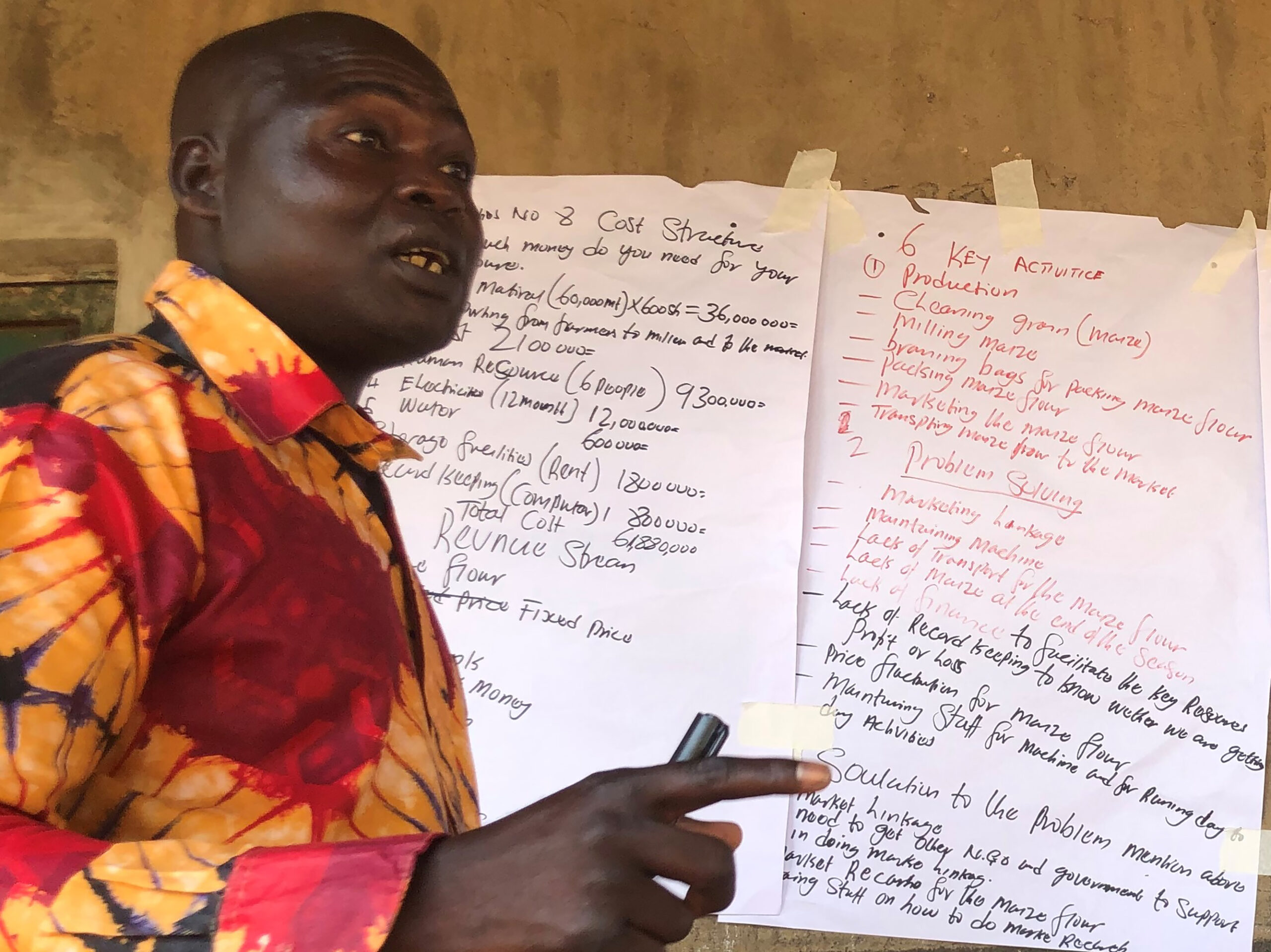

Capitalizing on our experience in adult education and change management, our PHB team designed and facilitated a series of highly interactive national-level workshops in 8 countries for 650 representatives from across the spectrum of the financial services ecosystem.

The workshops created a base-line understanding of the principles of interoperability between the broad set of stakeholders, thereby building their capacity to contribute to establishing the rules for an interoperable payment system. Through the workshops, PHB has helped to transform “the project of the Central Bank” into a project of all stakeholders, to be carried out jointly.

Building on the work done together in workshops, the PHB team drafted the three-year deployment strategy for the interoperable payment system and co-facilitated a regional consultation workshop to validate the plan.

Working together to maximize the impact

PHB, using techniques for consultation, change management and adult training has fostered a sense of ownership in the project by the stakeholders. BCEAO’s unifying role has inspired a climate of collaboration in which all parties feel that they can contribute to the creation of the system, thus increasing the likelihood of scaling the project for success.

Our know-how, rigour and ability to adapt have made PHB a partner of choice for BCEAO, but also the financial institutions and governments of the region. Financial institutions shared that PHB’s training had the merit of clarifying the interoperability mechanisms and allowed each actor represented to position itself to play its part,” pointing out that our “participatory approach has paid off.”

Ultimately, the partnerships and business models that emerge will come to benefit people like Espoir and his customers back home Dakar. With the first phase underway, the initial launch of the platform in West Africa is expected in fall 2020, with full deployment and reaching 90 million people by 2022.