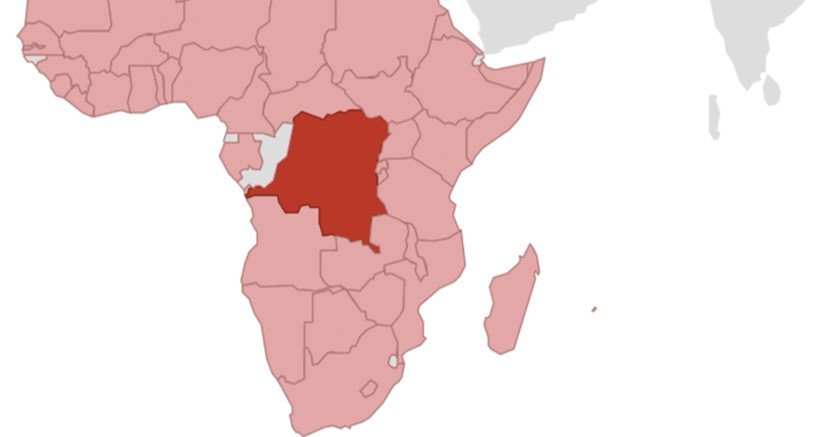

Development of digital credit and savings product for a Microfinance Institute (MFI) in the Congo (DRC)

Context: The MFI in DRC – in partnership with a mobile network operator (MNO) – is willing to launch a digital savings and loans product. The MFI is supplying its credit license and manages the savings and credit risk. The MNO is also providing its customer base and its agent network.

Objective: This product will enable instant credit scoring capabilities based on algorithms using enterprise and mobile data sources. One key data set considered will be the customers’ savings behaviors, which is expected to encourage customers to save with the MFI and therefore to mobilize savings, reducing the cost of funding for the institution. The core objective of the involved MNO for the digital credit and savings product is to increase customer acquisition and retention as a means of improving access and provision to affordable alternatives for customers, particularly those in rural areas.

Deliverables: 1) Market research: Perform desk review, Human-Centric Design (HCD) interviews and focus groups to understand client challenges. 2) Product design phase: Help prioritize product features based on customer insights. 3) Go-to-market definition: Define positioning and customer segmentation and elaborate value proposition. 4) Customer experience and product flow prototyping: Conduct Focus groups discussion/prototyping sessions to test early product features. 5) Business case elaboration: Gather Data and elaborate Business modeling and perform sensitivity analysis. 6) Preparation of pilot: Prepare Pilot Roll-out Plan

Stay Connected

Launch